Used retail prices showed little change but did drop barely in comparison with May, following consecutive increases within the previous two months.

Used-vehicle inventory levels initially of June dropped barely month over month, but inventory was relatively flat in comparison with early June 2024, in response to a Cox Automotive evaluation of vAuto Live Market View data released June 13.

As June opened, the whole supply of used vehicles on dealer lots – franchised and independent – across the U.S. stood at 2.21 million units, down from 2.22 million units initially of May but nearly unchanged from a 12 months ago.

The retail used-vehicle sales pace was regular month over month in essentially the most recent 30-day period. Used retail were at 1.53 million vehicles in May, unchanged from the 1.53 million reported in April. Following the run-up in March and the next slowdown in April, used retail sales look like holding regular for now. Sales remain higher than in recent times, with a 4% increase in comparison with the previous 12 months.

The Cox Automotive days’ supply is predicated on the estimated day by day retail sales rate for essentially the most recent 30-day period. Used vehicles had 43 days’ supply initially of June, down sooner or later from the upwardly revised level at the start of May and down two days in comparison with the identical period last 12 months. Days’ supply continues to be constrained, reaching its lowest level for this time of 12 months since 2021 and three days below levels seen in 2019.

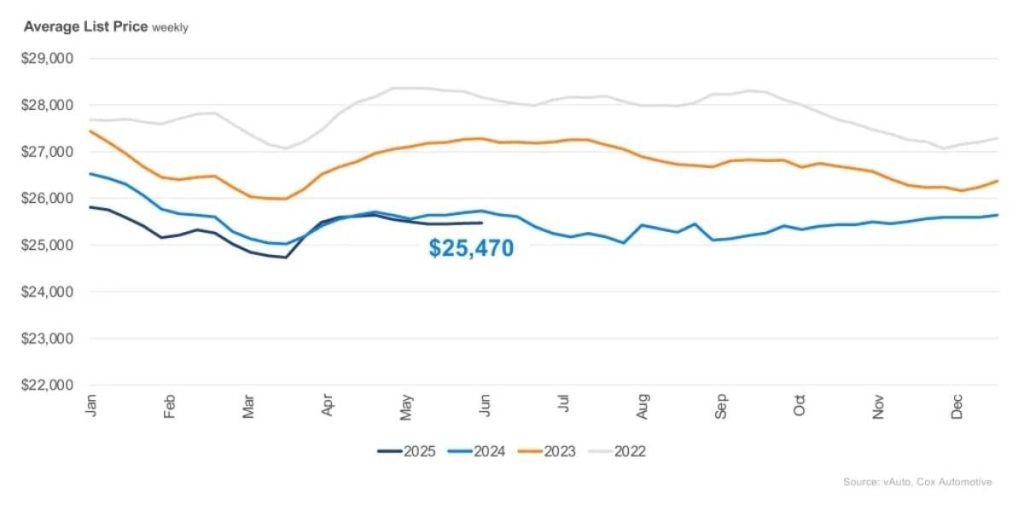

Used retail prices showed little change but did drop barely in comparison with May, following consecutive increases within the previous two months. The typical used vehicle listing price dropped to $25,470, down from the revised $25,490 at the start of May, representing a 1% decrease in comparison with the degrees observed a 12 months earlier.

Affordability stays difficult for consumers, and the used-vehicle supply is more constrained at cheaper price points. Used cars priced below $15,000 proceed to point out low availability, with only 31 days’ supply, five days lower than the identical period last 12 months and 12 days below the general industry average.

The highest five sellers of the month were listed at a mean price of $23,779, almost 7% below the typical listing price for all vehicles sold. Once more, Ford, Chevrolet, Toyota, Honda and Nissan were the top-selling brands, accounting for 50% of all used vehicles sold.

This Article First Appeared At www.automotive-fleet.com