Major market segments saw mixed trends for seasonally adjusted prices 12 months over 12 months in February.

Wholesale used-vehicle prices (on a mixture, mileage, and seasonally adjusted basis) were lower in February in comparison with January, in line with the newest numbers from Cox Automotive.

The Manheim Used Vehicle Value Index (MUVVI) decreased to 204.1, reflecting a 0.1% increase from a 12 months ago. The seasonal adjustment drove the monthly move, as non-seasonally adjusted values rose. The non-adjusted price in February increased by 1.4% in comparison with January, moving the unadjusted average price up 0.8% 12 months over 12 months.

“With gray days and winter storms, it’s not unusual to see some volatility in wholesale trends relative to long-term run rates in February, and that’s what we experienced over the course of the last 4 weeks,” said Jeremy Robb, senior director of economic and industry insights at Cox Automotive, in a March 7 news release. “Tax refund season drives the ‘spring bounce’ in wholesale markets, and it looks to have began off a bit slower this 12 months before ramping up at the top of February. The retail supply of used units is tighter than last 12 months’s, and tax refunds motivate consumers to buy used vehicles, leading to stronger dealer demand at Manheim within the last week of the month.”

Manheim Vehicle Values End Strong

In February, Manheim Market Report (MMR) values saw some volatility but ended with stronger price appreciation within the last week of the month, with values rising 0.2% within the last week alone. During the last 4 weeks, the Three-Yr-Old Index increased by 0.5%. Those self same 4 weeks delivered a mean increase of 0.2% between 2014 and 2019, indicating valuation trends were stronger than we often experience right now of 12 months.

Over the month, day by day MMR Retention, the common difference in price relative to the present MMR, averaged 99.0%, meaning market prices moved closer to MMR values this month and were higher against January levels. In comparison with last 12 months, valuation models were up by 1.1 percentage points (110 basis points) for MMR retention, one-tenth of a degree higher than 2019 levels for a similar period. The typical day by day sales conversion rate rose to 60.4%, a rise of two.1 percentage points in comparison with last month and a little bit higher than usual right now of 12 months. For comparison, the day by day sales conversion rate averaged 57.3% in February over the past three years.

Prices on Vehicle Segments Vary

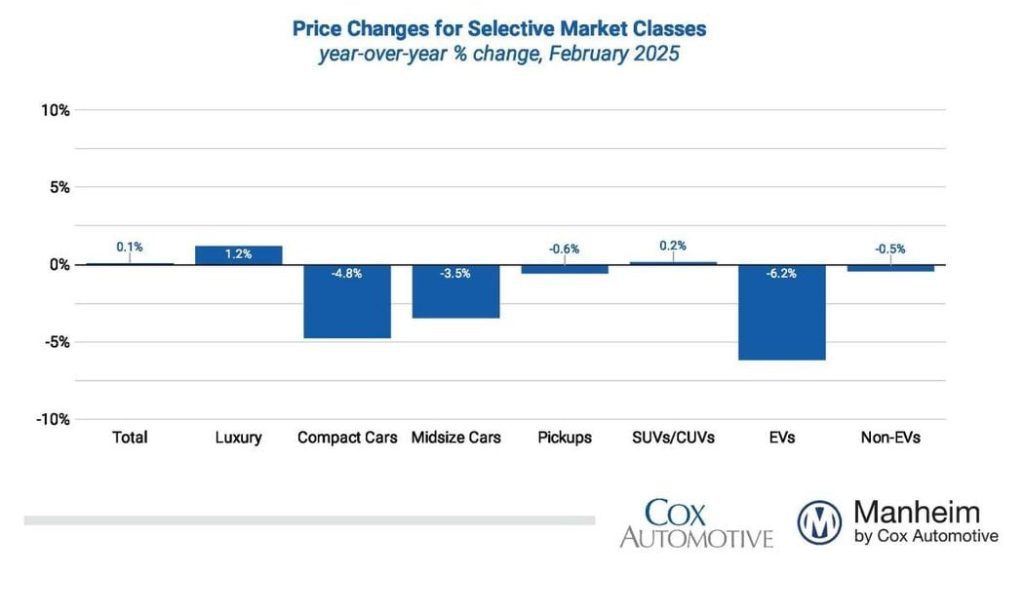

Major market segments saw mixed trends for seasonally adjusted prices 12 months over 12 months in February. In comparison with February 2024, the posh segment rose essentially the most, increasing by 1.2%, with SUVs also performing higher than the industry, increasing 0.2% over the past 12 months.

Compact cars declined essentially the most underperforming the industry, falling by 4.8% against last 12 months. Mid-size sedans were down 3.5%, and trucks fell by just 0.6%.

In comparison with the previous month, the truck segment performed one of the best, moving higher by 0.2%, while luxury and SUVs were also higher than the industry overall, falling by 0.5% and 0.7%, respectively. Faring worse than the industry, compact cars showed the most important decline, falling 1.6% over the past month, and mid-size sedans were down 1.1%.

the market by powertrain in February, electric vehicles (EVs) lost a number of the monthly gains seen in the previous few months. Still, they fell less against January than the industry overall. EV values were down 0.2% against January 2025, while non-EVs declined by 0.5% over the identical time period. For February 2025, EV values are down 6.2% against February 2024, while non-EVs were lower by 0.5% 12 months over 12 months, a bit lower than the general industry average.

Retail Used-Vehicle Sales Were Up in February

Assessing retail vehicle sales based on observed changes in units tracked by vAuto, initial estimates of retail used-vehicle sales in February were up 8% in comparison with January and better 12 months over 12 months by 8%. A used vehicle’s average retail listing price decreased 0.6% over the past 4 weeks.

Using estimates of retail used days’ supply based on vAuto data, an initial assessment indicates February ended at 45 days’ supply, down three days from 48 days at the top of January and down five days from February 2024 at 50 days.

Latest-vehicle sales in February were down 0.7% from last 12 months, yet volume increased 10.6% from a weaker January. The February sales pace, or seasonally adjusted annual rate (SAAR), got here in at 16.0 million, up 0.3 million from last 12 months’s pace and better than the weaker 15.5 million level in January.

Combined sales into large rental, industrial, and government fleets decreased 12.3% 12 months over 12 months in February. Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining latest retail sales were estimated to be up 3.9% from last 12 months, resulting in an estimated retail SAAR of 12.8 million, up 4.6% from last 12 months’s pace, and likewise higher than January’s estimated 14.0 million level. Fleet share was estimated to be 18.4%, down from last 12 months’s 22.0% share.

Rental Risk Price and Mileage Results Higher YOY

The typical price for rental risk units sold at auction in February increased 1.9% 12 months over 12 months. Moreover, rental risk prices rose by 1.2% in comparison with January. Average mileage for rental risk units in February (at 55,300 miles) rose 15.6% against last 12 months’s level, the best level for February readings since 2023. For February, the rental unit average mileage was 0.9% lower in comparison with January 2025.

Measures of Consumer Confidence Declined in February

- The Conference Board Consumer Confidence Index declined 6.6% in February, worse than the decline expected; but January’s index was revised higher. Consumers’ views of the current and the longer term declined, but views of the longer term declined essentially the most. Consumer confidence was down 6.2% 12 months over 12 months. Plans to buy a vehicle in the subsequent six months declined modestly to the bottom level since last February but plans to buy were barely higher 12 months over 12 months.

- The sentiment index from the University of Michigan declined 9% in February to 64.7, lower than expected and marked a bigger decline than the sooner reading in the beginning of the month. With the ultimate monthly decrease, the index was down 15.9% 12 months over 12 months to the bottom level since November 2023. The underlying views of current conditions and future expectations declined, with current conditions falling essentially the most. Expectations for inflation in a single 12 months increased to 4.3% from 3.3%, and expectations for inflation in five years increased to three.5% from 3.2%. Consumers’ views of shopping for conditions for vehicles declined to the bottom level since August as views of costs deteriorated. However the views of rates of interest were regular.

- Morning Seek the advice of’s day by day consumer sentiment index declined 1.7% in February, adding to the slight 0.1% decline in January. The index ended the month up 6.3% 12 months over 12 months.

- In keeping with AAA, the national average price for a gallon of unleaded gas remained at $3.10, unchanged in February from the top of January but down 7% 12 months over 12 months.

This Article First Appeared At www.automotive-fleet.com