Customer satisfaction with the vehicle purchase process continues to rise as new-vehicle inventory and pricing improve 12 months over 12 months, in line with the J.D. Power 2024 U.S. Sales Satisfaction Index (SSI) Study, SM released today. This 12 months, overall customer satisfaction with the vehicle purchase experience is 801 (on a 1,000-point scale), up from 793 a 12 months ago. Even so, gains in other features of the acquisition process reminiscent of personnel, paperwork and delivery are markedly smaller.

“In 2023, improvements in new-vehicle inventory and pricing moved customer satisfaction in an upward trajectory from the lows of 2022, and that’s apparent again this 12 months,” said Stewart Stropp, vp of automotive retail at J.D. Power. “It marks a return to form. As shoppers see a greater diversity of vehicles to pick from, pricing becomes more competitive across the market. But this 12 months’s study shows satisfaction with other parts of the sales experience has not improved nearly as much. Loads of opportunity stays to optimize the trail to buy.”

Following are some key findings of the 2024 study:

Percentage of buyers paying above MSRP declines considerably: With replenished inventory, buyers are rarely paying greater than the suggested retail price for vehicles. Amongst mass market buyers, only 8% paid greater than MSRP—an appreciable decrease from 15% a 12 months ago. Amongst premium vehicle buyers, only 6% paid greater than MSRP, down from 10% in 2023.

Meeting key performance indicators (KPIs): While 57% of buyers say nine or 10 of the highest 10 KPIs were met during their sales experience, 43% say eight or fewer were met, leading to substantially different levels of satisfaction. When nine or 10 KPIs are met, Buyer Index satisfaction averages 917. When seven or eight KPIs are met, the typical drops to 827—fully 90 points lower. Ensuring all KPIs are accomplished is essential to optimal satisfaction. Top KPIs include sales consultants completely understanding customer needs; vehicle condition upon delivery; and personnel effectively using technology.

BEV buyers still less satisfied than ICE buyers: While the gap between internal combustion engine vehicle (ICE) and battery electric vehicle (BEV) buyer satisfaction is getting smaller, BEV buyers are still notably less satisfied. Buyer Index satisfaction amongst mass market ICE vehicle buyers is 857 but drops to 822 amongst mass market BEV buyers—and the same pattern exists amongst buyers of premium vehicles. Moreover, each mass market and premium BEV buyers proceed to be less satisfied with dealer staff knowledge and expertise. Tesla buyers, particularly, have markedly lower satisfaction with the effectiveness of the vehicle features explanation.

Study Rankings

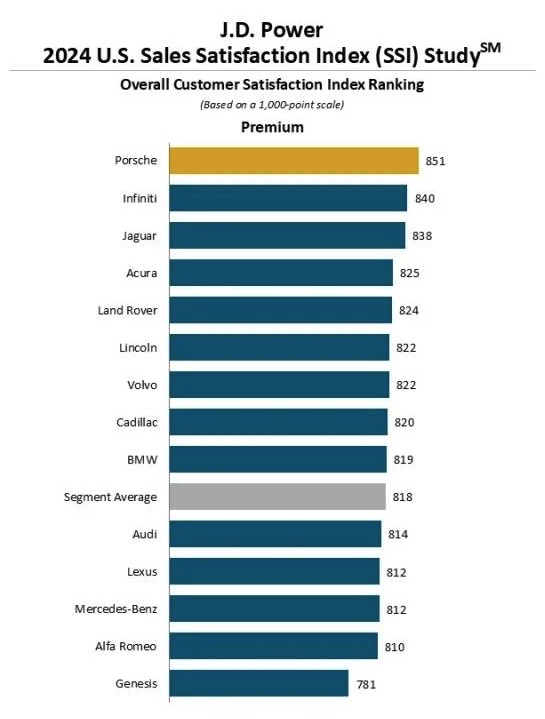

Porsche ranks highest in sales satisfaction amongst premium brands for a second consecutive 12 months, with a rating of 851. Infiniti (840) ranks second and Jaguar (838) ranks third.

MINI ranks highestin sales satisfaction amongst mass market brands, with a rating of 829. Buick (827) ranks second and Subaru (825) ranks third.

Segment Awards

The next are the highest-ranked brands in each segment:

Premium Automotive: Porsche (for a second consecutive 12 months)

Premium SUV: Porsche (for a second consecutive 12 months)

Mass Market Automotive: Nissan

Mass Market SUV/Minivan: Buick

Mass Market Truck: GMC (for a second consecutive 12 months)

Now in its thirty ninth 12 months, the U.S. Sales Satisfaction Index (SSI) Study measures satisfaction with the sales experience amongst new-vehicle buyers and rejecters (those that shop a dealership and buy elsewhere). Buyer satisfaction is predicated on six aspects (so as of importance): delivery process; dealer personnel; understanding the deal; paperwork completion; dealership facility; and dealership website. Rejecter satisfaction is predicated on five aspects: salesperson; price; facility; number of inventory; and negotiation.

The 2024 U.S. Sales Satisfaction Index (SSI) Study is predicated on responses from 34,596 buyers who purchased or leased their latest vehicle from March through May 2024. The study is a comprehensive evaluation of the new-vehicle purchase experience and measures customer satisfaction with the selling dealer (satisfaction amongst buyers). The study also measures satisfaction with brands and dealerships that were shopped but ultimately rejected in favor of the selling dealership (satisfaction amongst rejecters). The study was fielded from July through September 2024.

This Article First Appeared At www.autospies.com