The used automotive market is showing clear signs of renewed strength and resilience, in response to fresh data from AutoTrader, signalling a positive trajectory because the sector heads into the second half of the yr.

Buoyed by robust consumer confidence, stable prices, and fast turnover, July marked a big turning point, with each supply and demand dynamics aligning to create a healthy and competitive market environment.

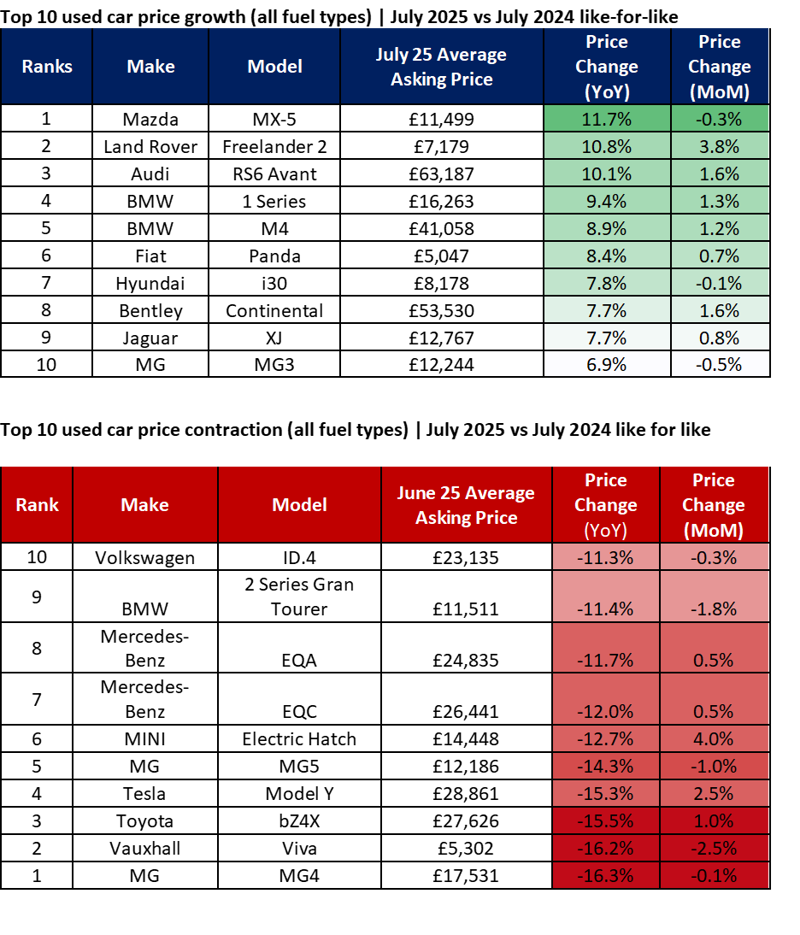

Based on around 800,000 retail market pricing observations, the typical price of a used automotive in July was £16,786 – flat on each a month-on-month and year-on-year basis. This marks the fourth consecutive month of YoY price stability, following 19 months of decline, and highlights the sector’s return to a more balanced footing.

AutoTrader’s Market Health metric also reflected this strength, posting its first upturn since January. The metric rose 1% YoY, constructing on an already solid 8% growth in July 2024. This improvement has been driven by a slowing supply growth rate of +1.1% YoY, which combined with 2% growth in demand, has provided a fertile landscape for recovery.

A key sign of this momentum is the quickening pace of car turnover. In July, used cars were sold on average every 29 days, which is sooner or later faster than July 2024, and three days quicker than July 2023 – a transparent indicator of rising consumer appetite.

AutoTrader’s latest consumer research supports this trend. Nearly 44% of 1,000 respondents surveyed in July said they felt “way more” confident about affording their next automotive compared with last yr. Moreover, in a separate study of over 2,000 people, roughly 70% said they intend to buy a vehicle inside the following six months.

This growing intent is mirrored in digital engagement: AutoTrader recorded around 85 million cross-platform visits in July, up 5.7% YoY and marking its biggest July audience on record. This follows similar record-breaking numbers in each May and June, reinforcing the market’s strong forward momentum.

This confidence is translating directly into sales. AutoTrader data shows the used automotive market grew 3.3% YoY in July. Nonetheless, performance differed between retailer types. Independent retailers saw a 6.1% increase in sales, while franchise retailers remained flat at 0.1%.

The divergence is partly because of vehicle availability. The provision of three–5-year-old cars, a key segment for franchised dealers, has dropped sharply for the reason that pandemic. Supply chain disruptions that continued until mid-2023 have taken a long-lasting toll, with volume falling from 4.8 million in 2019 to a projected 2.9 million by the tip of 2025.

In contrast, independent retailers have been less exposed to those supply shortages. They’ve benefitted from increased demand for older, cheaper vehicles, with interest in 5–10-year-old cars up 3% YoY, and demand for cars over 10 years old climbing 8.6%.

Commenting on the info, Marc Palmer, head of strategy and insights at AutoTrader, said: “The mix of swift sales, increasing site visits, and stable pricing underscores a dynamic and resilient sector, which should provide confidence for retailers because the market heads into the rest of 2025.

“Nonetheless, there remain significant nuances and challenges out there around supply, which is making the job of finding profitable cars increasingly more competitive. Using the info and insights available to assist source and price recent stock has never been more necessary, particularly where traditional stock profiles have been impacted.”

One of the notable growth areas continues for use electric vehicles (EVs). Supply surged 42.4% YoY in July, up from 38.1% in June, while demand grew 37.8%, accelerating from 28.6% the previous month. With supply only just outpacing demand, used EV prices are stabilising.

The typical price of a used EV was £24,727 in July, up 0.4% month-on-month – making EVs the one fuel type to see price growth within the month. Although EV prices remain down 6% YoY, this marks an improvement from the -7.6% decline recorded in June, and is the bottom level of annual contraction since January 2023.

By way of turnover, used EVs were among the many fastest-selling fuel types, taking just 28 days to sell – on a par with petrol vehicles. That’s a pointy improvement from the 32 days in June, when EVs were the slowest-selling segment.

This acceleration is partly driven by consumer response to the federal government’s recent £650 million Electric Automotive Grant. Following its announcement, AutoTrader recorded a 107% week-on-week spike in interest for EVs priced under £37,000, suggesting that demand within the used EV market may benefit from a long-lasting halo effect.

This Article First Appeared At www.am-online.com