“The elimination of EV tax incentives and public charging funding has the potential to affect two critical barriers to EV adoption: public charging availability and vehicle prices,” said Brent Gruber, executive director of the EV practice at J.D. Power. “This temporary slowdown in market share growth for EVs creates a novel challenge for the industry as manufacturers forge ahead with latest vehicle introductions. The EV market will probably be faced with expanded product offerings and flat share, creating increased competition.”

Following are some key findings of the 2025 study:

Opportunity to enhance BEV ownership experience via customer education: On this yr’s study, owners were asked if their dealership or manufacturer staff provided any specific education or training on points of EV ownership in the course of the purchase process. The study finds that 69% of first-time BEV buyers received some type of education or training when buying their vehicle. Nevertheless, in terms of the precise education topics needed to optimize the ownership experience, the range goes from a high of 46% of first-time buyers who received education on how specific features work to a low of 12% who were supplied with education for the full cost to own an EV. “First-time EV buyers are receiving minimal education or training,” said Gruber. “Dealer and manufacturer representatives play the crucial role of front-line educators, but in terms of EVs, the precise education needed to shorten the training curve just isn’t happening often enough. The shortfall in buyer education is something we’re seeing with all brands.”

Premium plug-in hybrid electric vehicles (PHEVs) could also be a viable alternative: Previous iterations of this study have found that PHEV owners were much less satisfied than BEV owners. Nevertheless, latest for this yr is the addition of the premium PHEV segment. Satisfaction amongst owners on this segment is 741, which is higher than mass market BEVs (725) and mass market PHEVs (632) and only 15 index points lower than satisfaction amongst owners of premium BEVs. For purchasers who’re hesitant to make the leap to a full EV, a premium PHEV could also be a satisfactory alternative.

Public charging woes persist but improvement seen amongst mass market owners: Although a big gap in satisfaction regarding public charger availability still exists between premium and mass market BEV owners, it’s now narrower than ever before. Amongst mass market BEV owners, satisfaction is up 86 points yr over yr (396) as infrastructure buildout continues and types profit from the opening of the Tesla Supercharger network. Satisfaction with public charger availability is highest amongst owners of premium BEVs (551).

BEV owners have strong intent to follow EVs for next vehicle purchase: Overall, 94% of BEV owners are likely to think about purchasing one other BEV for his or her next vehicle, a rate that can also be matched by first-time buyers. Manufacturers should be aware of the strong consumer commitment to EVs because the high rate of repurchase intent offers the power to generate brand loyal customers if the experience is a positive one. Actually, in the course of the past several years, the BEV repurchase intent percentage has fluctuated little or no, ranging between 94-97%. This yr’s study also finds that only 12% of BEV owners are likely to think about replacing their EV with an internal combustion engine (ICE)-powered vehicle during their next purchase. “With five years of conducting this study and surveying hundreds of EV owners, it’s apparent that after consumers enter the EV fold, they’re highly more likely to remain committed to the technology,” Gruber said.

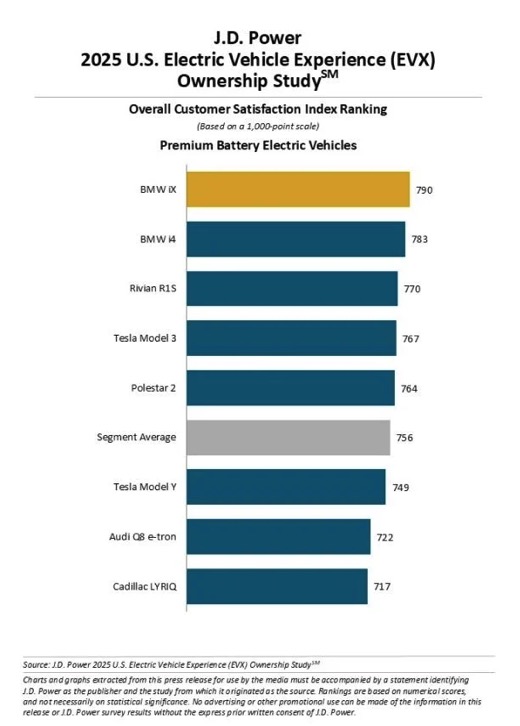

BMW iX ranks highest overall and highest within the premium BEV segment with a rating of 790. BMW i4 (783) ranks second and Rivian R1S (770) ranks third.

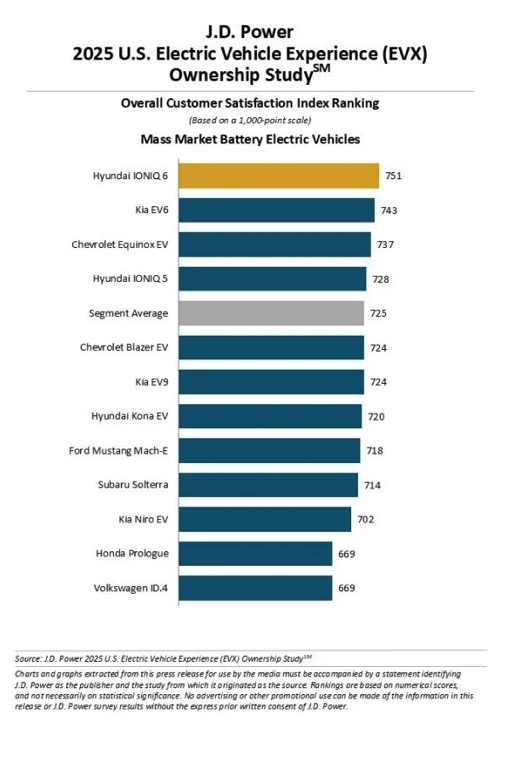

Hyundai IONIQ 6 ranks highest within the mass market BEV segment with a rating of 751. Kia EV6 (743) ranks second and Chevrolet Equinox EV (737) ranks third.

There are eight award-eligible models within the premium segment, which is unchanged from a yr ago, and 12 award-eligible models within the mass market segment, down from 14. Satisfaction amongst owners of premium BEVs averages 756, while satisfaction amongst owners of mass market BEVs averages 725.

The U.S. Electric Vehicle Experience (EVX) Ownership Study, now in its fifth yr, focuses on the crucial first yr of ownership. The general EVX ownership index rating measures electric vehicle owner satisfaction in each premium and mass market segments. The 2025 study includes 10 aspects (in alphabetical order): accuracy of stated battery range; availability of public charging stations; battery range; cost of ownership; driving enjoyment; ease of charging at home; interior and exterior styling; safety and technology features; service experience; and vehicle quality and reliability.

The study is conducted in collaboration with PlugShare, the leading EV driver app maker and research firm. This study sets the usual for benchmarking satisfaction with the critical attributes that affect the full or overall EV ownership experience for each BEV and PHEV vehicles. Survey respondents include 6,164 owners of 2024 and 2025 model-year BEVs and PHEVs. The study was fielded from August through December 2024.

This Article First Appeared At www.autospies.com