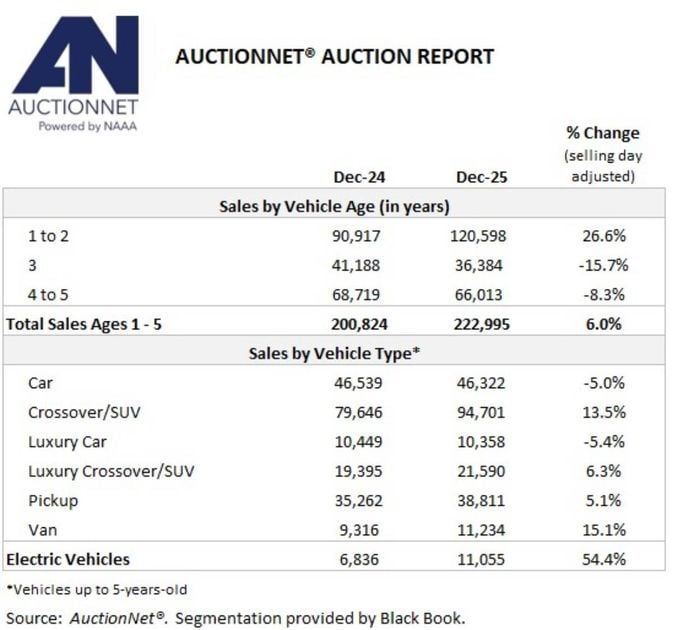

Late model and 7-year+ used vehicles recorded essentially the most sales in December and throughout 2025.

AuctionNet wholesale auction sales in 2025 continued to get better from the pandemic-induced lows of several years ago, with sales up greater than 4% yr over yr to only over 7 million units.

Last yr’s total sales figure was the best recorded since 2019, when sales reached 8.2 million units, and was greater than 1.2 million units above the 5.8 million units figured notched in 2022, when the automotive industry was coping with the fallout from recent vehicle production shortages.

Off-Rental Activity Drove Industrial Sales

Industrial sales powered last yr’s growth in auction volume, with sales up greater than 10% on a prior-year basis. The rise in business volume was driven by increased off-rental activity on vehicles as much as 2 years old, in addition to higher repossession volume on older vehicles.

Regarding the previous, rental automobile firms aggressively remarketed many 2023- and 2024-model-year units last yr to make way for more financially viable (i.e., slower-depreciating) 2025 models, which in turn pushed the variety of 1- to 2-year-old business vehicles sold at auction up by greater than 30% yr over yr.

As for the latter, business seller auction activity for 7-plus-year-old vehicles was elevated because consumers, stretched by persistently high inflation (amongst other aspects), increasingly defaulted on their auto loan obligations booked several years ago when used-vehicle prices peaked. Industrial sales of 7-plus-year-old vehicles were up 18% in 2025 in comparison with 2024.

The 2023 Nissan Rogue and the 2024 and 2023 MY Chevrolet Malibu dominated late model sales at auctions in December.

Dealer Auction Sales Follow Industrial Pattern

While growth was modest, dealer auction sales also moved higher in 2025, rising 3% year-over-year. Just like business sales, dealer growth was more pronounced for late-model and older vehicles, while sales of 3- to 5-year-old vehicles fell by a mean of 10% compared with 2024.

The drop in 3-year-old vehicle sales was resulting from the decline in recent vehicle sales and lease originations from 2022 when recent deliveries fell from 14.9 million units in 2021 to 13.8 million in 2022.

Nevertheless, the 2023 recovery in recent sales when deliveries exceeded 15.5 million units means more used off-lease/late model inventory will probably be available in 2026. That said, a large influx of those units at auction mustn’t be expected as dealers will gladly acquire as many clean, low-mileage units as possible to assist satisfy consumer substitute demand relative to their far costlier recent vehicle counterparts.

Acute Spike In EV Auction Sales

Mirroring the hockey-stick rise in recent deliveries recorded several years ago, electric vehicle auction sales grew sharply in 2025, up greater than 46% from 2024.

Holding a 49% share of EV auction sales, Tesla models again accounted for the lion’s share last yr, although competitive brands carved out a bigger presence across lanes (as must be expected going forward).

Given the big increase in recent EV sales and leases in 2023, AuctionNet expects to see way more electric vehicles enter the used market in 2026, at an estimated 250,000+ vehicles.

Finally, wholesale auction prices were relatively strong throughout 2025, ending the yr 3.5% higher than in December 2024.

For added context, annual depreciation checked in at just 12.6%, which was higher than each 2019’s pre-pandemic average of 13.8% and 2024’s 13.6% figure.

On condition that recent vehicle transaction prices will probably be near to, if not exceed, all-time highs and that used vehicle inventory will remain tight, expect to see one other yr of relative strength for wholesale prices overall in 2026.

Monthly AuctionNet data is derived from 265 National Auto Auction Association member auctions that use AuctionNet, and is taken into account essentially the most comprehensive source of wholesale auto auction sales data within the U.S.

This Article First Appeared At www.automotive-fleet.com