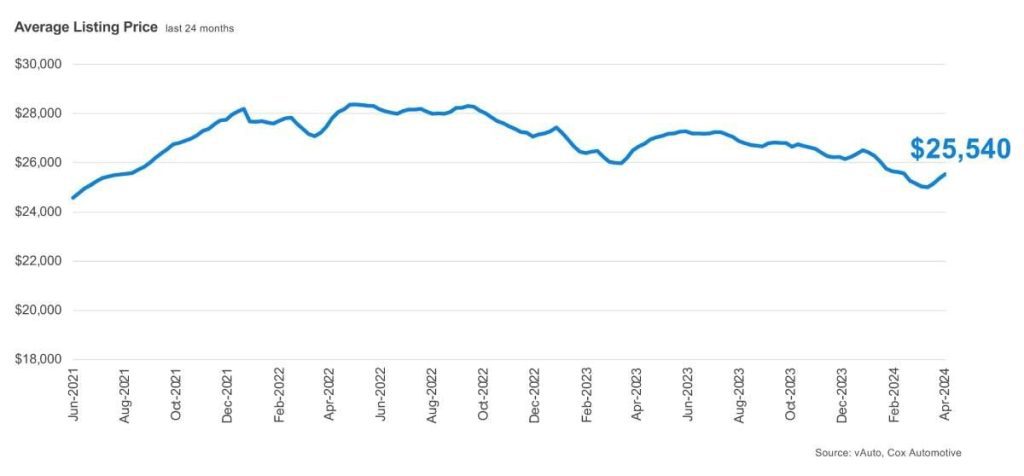

The common used-vehicle listing price was $25,540, up barely from the revised $25,121 at the beginning of March but down 4% from a 12 months earlier.

Graphic: Cox Automotive

Used-vehicle inventory levels at the beginning of April were lower than in March, in accordance with the Cox Automotive evaluation of vAuto Live Market data released April 19, as healthy sales fueled by tax refunds drew supply right down to the bottom level because the spring of 2023.

The overall supply of unsold used vehicles on dealer lots – franchised and independent – across the U.S. stood at 2.22 million units as April opened, up 6% from a 12 months ago but down from the revised 2.27 million units at the beginning of March.

As spring fever and tax refund season got underway, the market saw a typical heating of sales in latest and used vehicles, which brought down days’ supply. Used-vehicle days’ supply at the beginning of April fell to 44, compared with the revised 46 at the beginning of March, a 4% drop. Days’ supply at the beginning of April was equal to the year-ago level.

The Cox Automotive days’ supply is predicated on the estimated every day retail sales rate for essentially the most recent 30-day period, when sales were 1.5 million units. Used-vehicle sales within the period were up greater than 5% 12 months over 12 months, in step with tax refund season.

The common used-vehicle listing price was $25,540, up barely from the revised $25,121 at the beginning of March but down 4% from a 12 months earlier.

Interestingly, used cars below $15,000 proceed to indicate constrained availability with only 33 days’ supply, 25% lower than all other price ranges. Further, it emphasizes that affordability stays difficult for consumers, and provide is more constrained at lower cost points. The highest five sellers of the month, Ford, Chevrolet, Toyota, Honda and Nissan, accounted for 49% of all used vehicles sold at a mean price of $23,089, greater than 9% below the common listing price for all vehicles sold. The South is running with the bottom days’ supply.

This Article First Appeared At www.automotive-fleet.com