All major market segments saw seasonally adjusted prices that remained lower 12 months over 12 months in the primary half of August, yet the declines have been slowing recently.

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 0.5% from July in the primary 15 days of August, in response to the mid-month Manheim Used Vehicle Value Index released Aug. 19.

The index increased to 202.6, which was down 4.5% from August 2023. The seasonal adjustment softened the outcomes for the month. The non-adjusted price change in the primary half of August rose 1.6% in comparison with July, while the unadjusted price was down 5.2% 12 months over 12 months. The common rise for August is a rise of four-tenths of some extent for seasonally adjusted values, so the present change is in keeping with longer-term trends.

“The industry clearly experienced strength in wholesale values for the total month of July, and that trend has continued to this point into August,” said Jeremy Robb, senior director of economic and insights at Cox Automotive, in a news release. “The three-year-old segment is the biggest at Manheim, and wholesale values for those units have increased for five weeks in a row. Recently, we’ve got seen the strength broaden out, as values for a number of the older segments have also seen small gains week over week.”

Throughout the last two weeks, the Manheim Market Report (MMR) prices within the Three-12 months-Old Index reversed course and increased an aggregate of 0.4%, which was above the standard normal decline of 0.2% observed presently of 12 months. Over the primary 15 days of August, MMR Retention, the common difference in price relative to current MMR, averaged 99.4%, indicating that valuation models have moved closer to market prices early in August. MMR retention is up six-tenths of some extent in comparison with the prior 12 months at first of August, and it’s a bit stronger than the last two years.

The common each day sales conversion rate of 63.4% in the primary half of the month was above the August 2019 each day average of 60% and has clearly moved higher within the last two weeks. The conversion rate has risen 4 full points from July 2024, indicating the market is seeing stronger buying demand in recent weeks.

Vehicle Segment Prices Remain Below 2023 Levels

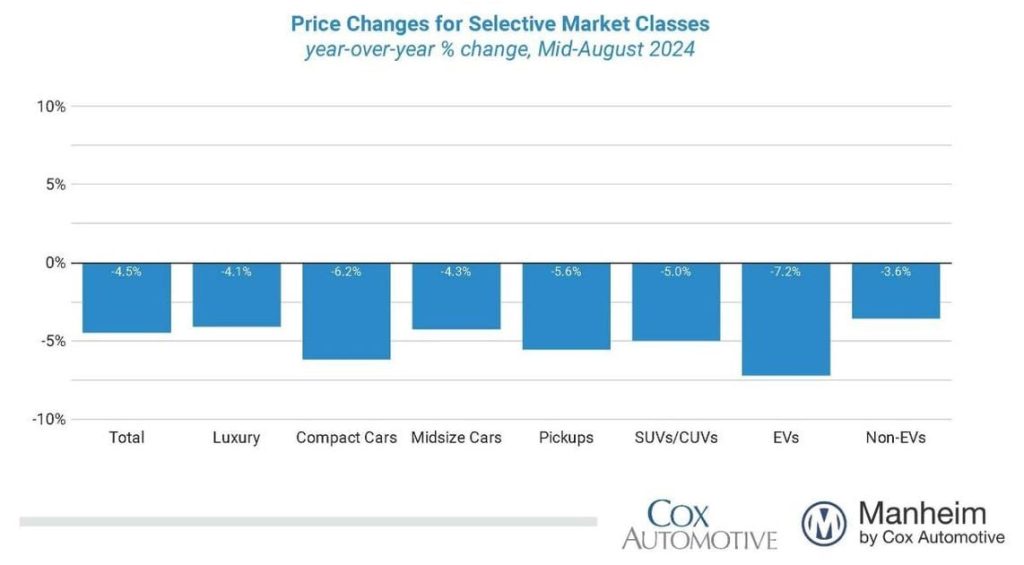

All major market segments saw seasonally adjusted prices that remained lower 12 months over 12 months in the primary half of August, yet the declines have been slowing recently. In comparison with the industry’s year-over-year decline of 4.5:

- The posh segment declined by 4.1% against 2023

- Midsize cars fell by 4.3% over the identical period.

- Falling greater than the common, SUVs were down 5%

- Pickups fell by 5.6%

- Compact cars declined 6.2% 12 months over 12 months.

Comparing results against the top of July, just about all segments rose. The general industry rose by 0.5% against the prior month, and the posh segment was higher by 2.3% with midsize cars increasing by 1.2%. The SUV segment rose lower than the industry overall, increasing 0.4%, and the pickup segment was higher by 0.2% against July 2024. The compact automobile segment declined 0.4% month over month.

Seasonally adjusted electric vehicle (EV) values for the primary half of August were down 7.2% against August 2023, while the non-EV segment decreased by 3.6% over the identical period.

In comparison with July, EVs increased 4.4% in the primary half of August, while non-EVs were up 1.1% within the month.

Wholesale Supply Is Down in Mid-August

Leveraging Manheim sales and inventory data, Cox estimates that wholesale supply ended July at 27 days, up in the future from the top of June yet down in the future against July 2023 at 28 days. Wholesale supply is comparatively normal for this time of 12 months, running mainly in the future lower longer-term levels for this week. As of Aug. 15, wholesale supply decreased by two days from the top of July, moving to 25 days, flat against year-over-year levels.

Measures of Consumer Sentiment Showing Mixed Trends

- The initial August reading on consumer sentiment from the University of Michigan increased 2.1% to 67.8, which was a bit stronger than expected. If that level holds or is healthier for the month, it’s going to end a four-month streak of declines, but sentiment stays very low and down 2.3% 12 months over 12 months. Future expectations drove the rise as views of current conditions declined. Expectations for inflation in a single 12 months and in five years were unchanged from July. Consumers’ views of shopping for conditions for vehicles improved barely but remain at very low levels. Consumers’ views of car prices and rates of interest remain very negative.

- The each day index of consumer sentiment from Morning Seek the advice of is unchanged in mid-August though sentiment has been somewhat volatile. The index increased 2.9% in July and was up 4% against last 12 months as of Aug. 15. Sentiment is up 1.1% 12 months thus far.

- The common unleaded gas price, has decreased 1.4% month thus far to $3.43 per gallon as of Aug. 15, in response to AAA. Gas prices are down 11% 12 months over 12 months but up 10% 12 months thus far.

This Article First Appeared At www.automotive-fleet.com