All major market segments saw seasonally adjusted prices that remained lower yr over yr in the primary half of June.

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) decreased 0.3% from May in the primary 15 days of June, in response to the mid-month Manheim Used Vehicle Value Index released June 18.

The index fell to 196.8, down 8.5% from June 2023. The seasonal adjustment lessened the impact for the month. The non-adjusted price change in the primary half of June declined 1.6% in comparison with May, while the unadjusted price was down 9.5% yr over yr.

“May ended with stronger than normal price declines in the previous few weeks, and that’s continued into early June,” said Jeremy Robb, senior director of economic and insights at Cox Automotive, in news release. “We’re still seeing higher sales conversion levels with days’ supply down as sales have continued to run above last yr’s levels.”

Throughout the last two weeks, the Manheim Market Report (MMR) prices within the Three-Yr-Old Index decreased an aggregate of 0.9%, which was above the everyday normal decline of 0.2% observed at the moment of yr. Over the primary 15 days of June, MMR Retention, the common difference in price relative to current MMR, averaged 98.7%, indicating that valuation models are lagging behind market prices early in June. MMR retention is down one-tenth of some extent in comparison with the start of June 2023.

The common day by day sales conversion rate of 57.8% in the primary half of the month was below the June 2019 day by day average of 60.7%. The conversion rate has risen almost two points from May 2024, indicating stronger buying demand at wholesale markets because the end of May.

Vehicle Prices Languish Below 2023 Levels

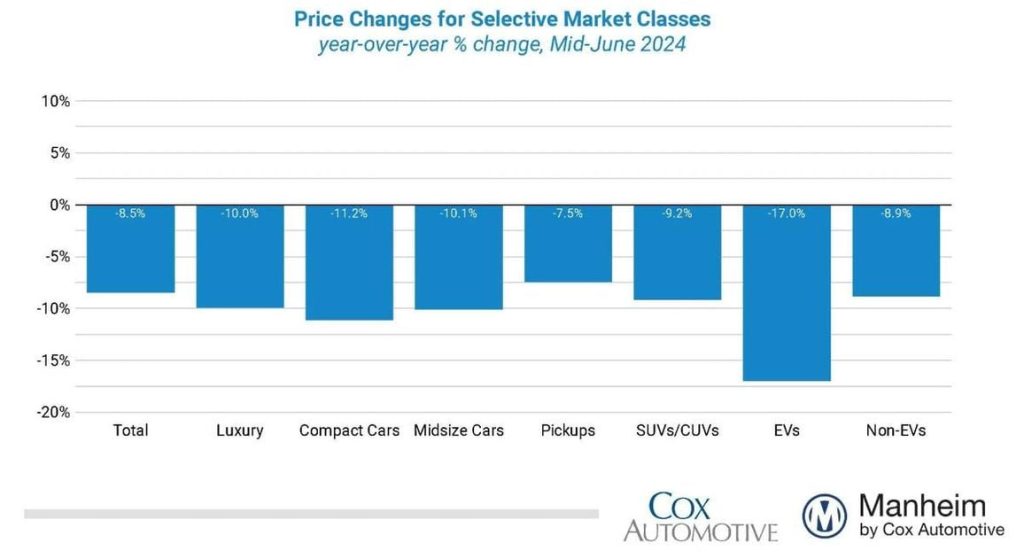

All major market segments saw seasonally adjusted prices that remained lower yr over yr in the primary half of June.

- In comparison with the industry’s year-over-year decline of 8.5%, the pickup segment was the one group to outperform the index overall, falling by 7.5% against 2023.

- The remaining segments did worse yr over yr, with SUVs down 9.2%, luxury falling by 10.0%, midsize cars declining 10.1%, and compacts performing the worst at down 11.2% yr over yr.

Several major segments demonstrated smaller price declines in comparison with May against the index performance.

- The general industry fell 0.3% against the prior month; but SUVs increased by 0.5%, compact cars rose by 0.4%, and midsize cars rose by 0.2% over the identical period.

- Falling greater than the common, pickups were down 0.5%, and luxury declined by 1% against May 2024.

- Electric vehicles (EVs) were down 17% against values for June 2023, while the non-EV segment decreased by 8.9% over the identical period. In comparison with May, non-EVs increased 0.4% in the primary half of June, while EVs were down 7.1% over the identical period.

Wholesale supply is flat in mid-June. Leveraging Manheim sales and inventory data, Cox estimates that wholesale supply ended May at 26 days, up sooner or later from the tip of April and in addition against May 2023. Wholesale supply is comparatively normal for this time of yr, running inside a day of longer-term levels for this week. As of June 15, wholesale supply was unchanged from the tip of May at 26 days and year-over-year levels. Nonetheless, wholesale supply stays down sooner or later in comparison with 2019.

Rental Risk Prices Declined in Early June

The common price for rental risk units sold at auction in the primary 15 days of June was down 15.2% yr over yr. Rental risk prices also declined by 5.7% in comparison with May. Average mileage for rental risk units in the primary half of June (at 49,900 miles) was down 12% in comparison with a yr ago and fell by 11.6% against May 2024.

Consumer Sentiment Falls to Lowest Level in a Yr

- The initial June reading on Consumer Sentiment from the University of Michigan fell 5.1% to 65.6, the bottom level since June 2023. Views of current conditions declined more substantially than future expectations. Expectations for inflation in five years increased. Consumers’ views of shopping for conditions for vehicles fell to the bottom level since November 2022. Consumers’ views of car prices declined, however the view of rates of interest was barely less negative.

- The day by day index of consumer sentiment from Morning Seek the advice of continues to maneuver around and fell last week. Sentiment declined 2.1% in May and was down 0.4% over the past week, though it’s up 0.7% as of June 15. Sentiment is down 0.6% yr so far.

- The common unleaded gas price, in response to AAA, increased 0.1% over the past week to $3.45 per gallon as of June 15, which was down 2% yr over yr and up 10.8% yr so far. In June, gasoline prices are down 3.1%.

This Article First Appeared At www.automotive-fleet.com