Volkswagen Financial Services (VWFS) has confirmed it’s winding down its Heycar marketplace division.

VWFS, which is Heycar’s majority shareholder, said that the technology and expertise developed by Heycar will likely be rolled right into a recent subsidiary in a “strategic move that underscores VWFS UK’s commitment to innovation and enhancing our technological capabilities”.

A spokesperson for VWFS said: “Heycar has been a pioneer in the net used automotive marketplace and, despite the choice to wind down their operations, the worthwhile insights and digital solutions developed to this point will play a vital role in the longer term of VWFS UK, as we proceed to explore recent ways to drive growth and innovation within the automotive e-commerce space.”

VWFS refused to comment on when the Heycar business will likely be closed, but AM understands it can be before the tip of the summer.

Heycar had been through a restructuring process in a “ruthless” drive to deliver profitability back in January 2023.

The corporate was launched back in 2017 in Berlin with the backing of VWFS, Daimler Mobility and Volkswagen.

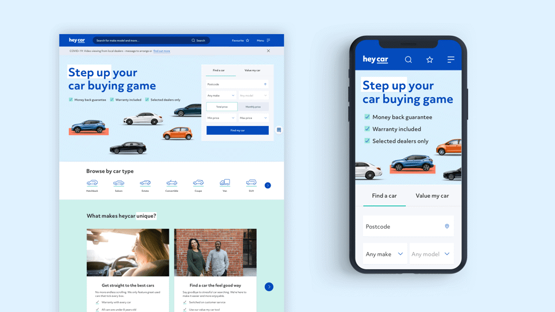

Heycar expanded to the UK in 2019 to act as a market disruptor against established rivals.

Daimler decided to sell its shares in Heycar a couple of years later in 2023.

Originally launching within the UK as classified marketplace, Heycar since launched an e-commerce option for patrons.

The RAC partnered with Heycar last 12 months in a bid to relaunch the platform in a five 12 months deal.

On the time, Alex Grime, chief of staff at Heycar, said: “We’re delighted to be partnering with the RAC, one of the trusted and loved brands within the UK.

“With our all-new platform, we will likely be providing a compelling level of auto selection and a contemporary automotive buying experience for consumers, while for our automotive retailers, the RAC Cars site will help extend the reach of their vehicles to a prime quality audience of in-market automotive buyers.”

The web classifieds marketplace segment within the UK is extremely contested and congested, with other brands like Auto Trader and Motors competing for dealers’ marketing spend.

Auto Trader continues to be the market leader within the UK, but rival Motors announced that it will be using the Cazoo brand name and its network of brands to challenge that position in the approaching months and years.

Meanwhile Auto Trader is expanding its position not only as a marketplace, but as a technology provider to dealers with its artificial intelligence (AI) powered Co Driver tools.

This Article First Appeared At www.am-online.com