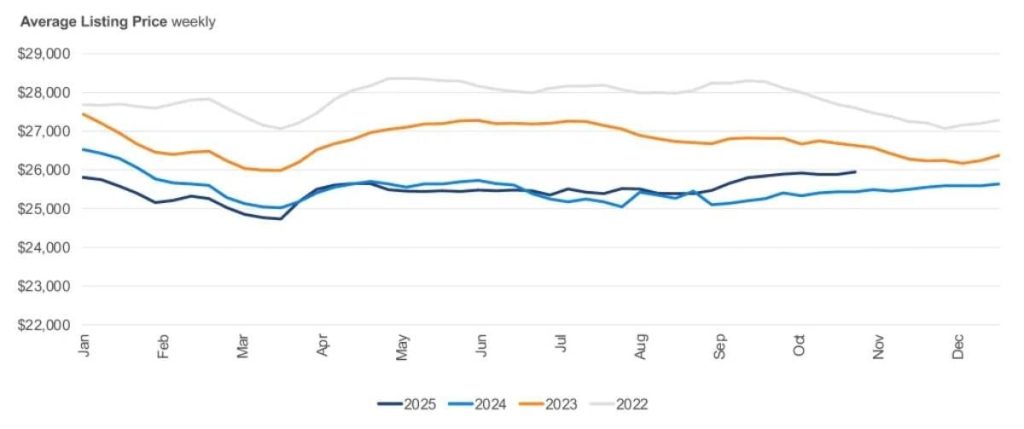

The common used vehicle listing price increased to $25,945, up from the revised $25,889 at first of October.

Used-vehicle inventory levels rose again at the beginning of November, surpassing the previous 2025 high set in October, in accordance with Cox Automotive’s evaluation of vAuto Live Market View data released Nov. 14.

Meanwhile, retail used-vehicle sales in October increased month-over-month in comparison with September, as the typical used-vehicle listing price increased to $25,945, up from the revised $25,889 at first of October and up 2% in comparison with the degrees observed a 12 months earlier.

Higher Inventory Still Stays Below 2019 Levels

Nationwide, dealers – each franchised and independent – had a complete supply of two.26 million used vehicles on their lots at first of November. That figure was 1% higher than the revised 2.23 million in early October and is 3% higher than the identical time last 12 months.

Days’ supply is predicated on the estimated every day retail sales rate for essentially the most recent 30-day period. Used vehicles had 48 days’ supply at the beginning of November, down in the future from the upwardly revised level at first of October but up in the future in comparison with the identical time last 12 months.

Although the times’ supply remained above levels seen within the prior 12 months, it stays constrained and below the degrees observed in recent times, in addition to in 2019.

Used Automobile Buyers See Good Purchasing Window

The retail used-vehicle sales pace was up over 3% month over month in essentially the most recent 30-day period. Used retail sales reached 1.4 million vehicles in October, up from the 1.36 million reported in September.

The October bump was almost certainly driven by what purchasers view as a good purchasing window, with aspects akin to improved credit access contributing alongside the used market’s strong value proposition, which offers cheaper alternatives than the new-car segment. Sales remain strong, up 2% in comparison with the previous 12 months.

Scott Vanner, manager of economic and industry insights at Cox Automotive, noted in a news release: “After stabilizing from a September slowdown, sales trended higher in October, likely driven by buyers viewing this as a good purchasing window, with aspects akin to improved credit access and the used market’s value proposition contributing to the momentum.”

Buyers Still Looking for Lower-Priced Vehicles

The rise can mostly be attributed to a rise within the share of newer model years in the combination.

Price-conscious buyers have limited options for reasonably priced used vehicles. Used cars priced below $15,000 proceed to have low availability, with only 34 days’ supply, which is 14 days below the general industry average.

The highest five sellers of the month were listed at a mean price of $24,037, greater than 7% below the typical listing price for all used vehicles sold. Once more, Ford, Chevrolet, Toyota, Honda and Nissan were the top-selling brands, accounting for 50% of all used vehicles sold.

This Article First Appeared At www.automotive-fleet.com