This yr is a period of reorientation for MG Motor UK. After 4 years of heavy deal with the fleet, Motability and rental markets, which delivered rapid growth in its overall automotive parc, it has its sights on the steadier, stagnant even, retail recent automotive market.

It’s positive news for MG dealers, who’re also beginning to see the advantages of a bigger 1-5 yr automotive parc and the opportunities that provides them in service, repair and used automotive sales.

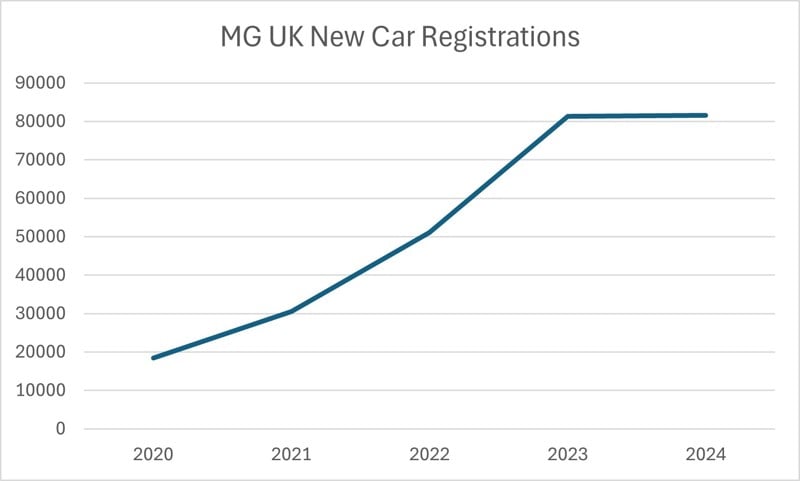

That doesn’t mean MG will accept a drop in recent automotive registrations, which neared 82,000 in 2024, well ahead of value-market rivals Citroen, Dacia and Skoda, and even outselling Vauxhall. In an interview with Automotive Management the brand’s business director Guy Pigounakis says he could be “mortified” to sell fewer cars this yr than last. “Absolutely is not going to occur,” he adds.

This yr is a period of reorientation for MG Motor UK. After 4 years of heavy deal with the fleet, Motability and rental markets, which delivered rapid growth in its overall automotive parc, it has its sights on the steadier, stagnant even, retail recent automotive market.

It’s positive news for MG dealers, who’re also beginning to see the advantages of a bigger 1-5 yr automotive parc and the opportunities that provides them in service, repair and used automotive sales.

That doesn’t mean MG will accept a drop in recent automotive registrations, which neared 82,000 in 2024, well ahead of value-market rivals Citroen, Dacia and Skoda, and even outselling Vauxhall. In an interview with Automotive Management the brand’s business director Guy Pigounakis says he could be “mortified” to sell fewer cars this yr than last. “Absolutely is not going to occur,” he adds.

There will probably be some growth, but MG accepts the years of exponential growth are finished.

“If someone said to me we’ve got to do 100,000 cars this yr we could do those 100,000 cars, and the good thing about that to us as a manufacturer might be more parts sales, more cars on the road, more used cars and more brand awareness, but from our dealer partners’ perspective we’d be diverting some stock away from them, that they may retail, to fill those high discount channels,” said Pigounakis.

The battle is getting bloodier with the likes of BYD and Omoda, each fellow Chinese brands, discounting to win sales. In a UK recent automotive market that’s slow to grow overall their ambitions will come at other brands’ expense, typically the ‘legacy manufacturers’. Plus later within the yr, with the ZEV Mandate in play, some manufacturers will act to ‘shore up’ their position.

Pigounakis says MG is in a fortunate position of not having to react to short-term problems. It has a superb mixture of EV versus ICE sales, and the products it has recently introduced, similar to the petrol-engined MG3 and ZS which each start at below £20,000, offer good sales opportunities, even in the event that they might sound to be against the industry’s direction of travel.

Pigounakis says MG is in a fortunate position of not having to react to short-term problems. It has a superb mixture of EV versus ICE sales, and the products it has recently introduced, similar to the petrol-engined MG3 and ZS which each start at below £20,000, offer good sales opportunities, even in the event that they might sound to be against the industry’s direction of travel.

Nevertheless, he admits he has warned MG dealers that he might restrict supply of those in quarter 4 if he needs to guard the balance. It has expanded its EV range too this yr, introducing the MGS5 crossover SUV to partner its best-selling MG4 electric hatchback.

This autumn one other automotive will probably be introduced, competing in a brand new segment for the brand. It is anticipated to be an electrical city automotive.

MG finds its strategy of aggressive list prices and few optional extras keeps it easy for each dealers and retail customers and it’s achieving ‘cut-through’ to buyers even in a difficult market. Its strapline is ‘Get More’ and that’s particularly valid. Pigounakis believes retail buyers are more price sensitive than they’ve been for a very long time. Those nearing the tip of a mainstream brand’s three or 4 yr PCP that was signed on a low APR are actually discovering their cost to vary has risen significantly in the event that they want something recent from the identical brand with similar equipment levels. That plays into MG’s hands.

Much more buyers might be tempted by the nearly recent cars on dealers’ forecourts. MG does the vast majority of its rental sales on buy-back agreements so there may be sufficient supply of low mileage, sub-one-year stock. Meaning even a barely used AM Award winning electric MG4 or petrol HS could possibly be in a buyer’s hands for £15,000 and a ten,000 mile MG3 could sell for under £12,000.

Much more buyers might be tempted by the nearly recent cars on dealers’ forecourts. MG does the vast majority of its rental sales on buy-back agreements so there may be sufficient supply of low mileage, sub-one-year stock. Meaning even a barely used AM Award winning electric MG4 or petrol HS could possibly be in a buyer’s hands for £15,000 and a ten,000 mile MG3 could sell for under £12,000.

“I’d say they’re almost without peer in that sector,” says Pigounakis. Currently around 80% of MG dealers are buying nearly-new cars from the brand, which is now offering ten times as many per 30 days because it was 18 months ago. He said the programme is just not mandatory however it is in dealers’ interest to be involved. One issue has been the high volume of single derivatives that were provided to rental firms, but MG is broadening the combo now and expects that to entice more dealers to purchase stock.

MG is working on some changes to the approved used automotive programme this yr. Pigounakis seens no issue with its competitiveness, given used MGs have the balance of their seven yr warranty. So the alterations, determined from working with the dealer network, will likely relate to stocking charges and stepping up national marketing of used MGs, something which has generally been left to individual dealers.

He says the most important barrier to greater used automotive success is the flexibility of MG’s remarketing suppliers to organize enough cars to satisfy demand. Quick to state this is just not a criticism of those partners, he adds that the well reported shortage of technicians and facilities are the cause. “We probably could have sold three or 4 thousand more cars last yr if we had the entire logistical chain sorted out.”

In aftersales dealers are actually beginning to reap the advantages of MG sales growths. Return three years and PDIs and part-exchange refurbishment was a lot of the work MG technicians could be doing, but they are actually beginning to get more of the numerous service and maintenance jobs. With that, and with two thirds of MG dealerships sharing the situation with one other franchise, comes some challenges around lead times, so this has led MG to structure an additional 1% into the dealer margin linked to aftersales KPIs, to maintain MG owners in focus.

Pigounakis adds: “Dealers have gotten to become profitable, and so they’ve other brands and customers, that they’ve responsibilities to so, candidly, if we would like to get greater than our percentage share of voice in a workshop then we’re going to should pay a bit of bit.”

A criticism of MG, which dealers have flagged to Automotive Management, is that the national sales company itself has not scaled up enough consistent with its volume growth, to support the dealerships.

Pigounakis accepts the criticism, particularly for the aftersales customer care side. The AA is now managing MG’s call centre, and the carmaker is partnering a serious rental company in a brand new programme to make sure MG drivers can stay mobile if their cars are off the road having repairs.

A few of MG’s early partners, who helped the brand re-establish a foothold within the UK under Chinese ownership, have been casualties of its ambitions within the last 5 – 6 years. To quadruple its UK sales it needed franchisees able to take a position heavily in staff and facilities in preparation for selling lots of of cars. The profile of the MG dealer network today is less about owner-driver businesses and more about AM100 dealer groups as partners from Arnold Clark to Waylands got here on board.

A few of MG’s early partners, who helped the brand re-establish a foothold within the UK under Chinese ownership, have been casualties of its ambitions within the last 5 – 6 years. To quadruple its UK sales it needed franchisees able to take a position heavily in staff and facilities in preparation for selling lots of of cars. The profile of the MG dealer network today is less about owner-driver businesses and more about AM100 dealer groups as partners from Arnold Clark to Waylands got here on board.

Pigounakis said among the older dealers are still leaving and usually are not pleased about it. “It sounds awful and I’m not criticising them, but they type of don’t understand why we’ve moved within the direction we have now. And among the dealerships can’t physically handle their share of 80,000 cars, they don’t have the facilities and so they don’t have the balance sheet to support the funding required to run that scale business.”

Because the growth with AM100 groups around a 3rd of the MG network is in solus showrooms. The brand prefers, but doesn’t mandate, solus representation, but Pigounakis appreciates that the increased energy and National Insurance costs plus the extraordinary competition for retail buyers makes it harder for dealerships to get a powerful return.

The 155-site network is hoped to achieve 160 outlets by the tip of 2025, which supplies MG 92% coverage of the UK. In some cases a dealer group may open a dealership in a fundamental market town a number of miles from an existing small dealer, and MG is pleased to see how that plays out over time quite than issue terminations.

“I’m quite proud that we take a really light touch approach with our dealer partners. I believe by and enormous we have now good relationships with our partners.”

This Article First Appeared At www.am-online.com