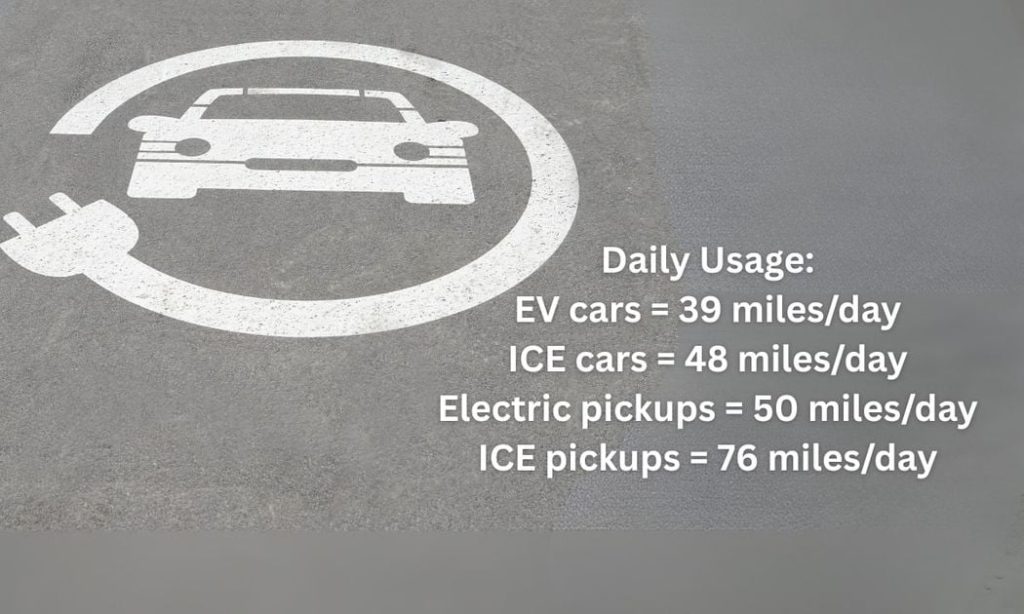

Electrification challenges are distinct amongst fleets, but small EV cars are keeping pace with ICE cars in every day mileage— at 39 miles and 48 miles— proving that the challenges will be overcome.

As fleets integrate electric vehicles (EVs), clear utilization patterns are emerging — and so they vary between vehicle types.

Utilization Trends: How Are Fleets Using EVs Today?

EV small cars are functioning as true like-for-like replacements for his or her internal combustion engine (ICE) counterparts. They’re getting used in much the identical way because the ICE small cars they’re replacing, often serving as general-purpose fleet assets.

Pickups, nevertheless, follow a special trend. EV pickups, which hit the market in force throughout the past 1-2 years, are usually not yet functioning as direct replacements for ICE pickups in high-utilization roles. As an alternative, they’re more commonly deployed as supervisor vehicles or supplemental assets, fairly than primary work trucks.

Our trend data shows that the common every day usage rate of an EV small automotive is just 0.6% lower than the common every day usage rate of an ICE small automotive for Q1 2023 through Q1 2025. Meanwhile, EV pickups, a more moderen entry to the Fleet space, report 13.5% less average usage than the ICE counterpart1. Nevertheless, the EV pickups have shown a gentle increase of their usage — from 36.3% in Q1 2023 to 45.9% in Q1 2025. This implies growing confidence in EV capabilities for some light-duty applications, while heavier-use assets are still finding their role in electric fleets.

- Purchase Trends: Inside the EV Consortium, x% of assets purchased have been EVs. Inside the EV Consortium, prior to 2020 just 5% of assets purchased have been EVs and 9% were hybrids (HEV/PHEV) whereas since 2020 13% of assets purchased are EVs and 22% hybrids (HEV/PHEV)3. This growing percentage of fully or partially electric vehicles demonstrates confidence in EV technology and a desire to comply with corporate sustainability goals and state mandates.

- Usage Trend Over Time: Quarterly data reveals regular increases in small electric cars miles, while EV pickup utilization grows more steadily as fleets experiment with their ideal use cases.

Charging Habits and Battery % Remaining: What Happens When EVs Return to Base?

Range anxiety is a well-documented concern in fleet electrification. Our 2024 Driver Sentiment Survey supports this conclusion with about 50% of respondents listing lack of range or range anxiety as primary concerns with driving an EV. 22% of respondents expressed a insecurity that the EV would get them to and from their destination.

The fact often looks very different. Charging behavior and battery management make clear how EVs are literally performing in fleet operations. Data from the EV Consortium shows that in 2024 EV pickups return to their chargers at the tip of their shift with 67% battery remaining4. For off-session periods where the vehicle drove a minimum of 30 miles, it’s estimated that Full-size pickups could travel an extra 206 miles based on the kWh remaining5 — way over what’s needed to satisfy their every day driving requirements or the every day driving requirements for an ICE pickup.

- Every day Miles Driven: EV small cars are keeping pace with ICE small cars in every day mileage, at 39 miles and 48 miles respectively, proving they’re well-suited to traditional fleet roles. EV pickups, then again, average about 26 miles fewer miles per day than their ICE counterparts at 50 miles per day and 76 miles per day, respectively6.

- Range Anxiety Disconnect: Driver sentiment survey results consistently highlight range anxiety as a priority, despite data showing that the majority EVs return to their chargers with ample battery remaining.

Observed Range vs. Manufacturer Capability: Real-World Proof

The strongest tool for overcoming range anxiety? Real-world data. By comparing actual fleet performance with manufacturer-stated range, inside the Consortium, we observe that EVs typically operate well inside expected ranges. This proof helps fleet managers construct trust in EV capabilities, support expansion into higher-mileage duty cycles, and address the range concerns of drivers.

For instance, the prolonged range for Ford Lightning promised ~300 miles and the median range observed is 294 miles. The prolonged range for Chevrolet Silverados promised ~400 miles and the median range observed is 438.7

Real-world performance data helps fleet managers set realistic expectations about what job assignments and geographies are reasonable and counter outdated assumptions about EV range limitations.

Concerning the Electric Vehicle Consortium

The Electric Vehicle Consortium brings together fleet professionals, data analysts, and sustainability administrators to collaborate on solving the unique challenges of fleet electrification. Our members profit from real-world data insights, collaborative research, and a robust peer network. Desirous about joining or sponsoring? Contact us at evconsortium.org to learn more.

Data Sources

- EVC Dataset, 2023-2025

- Utilimarc Fleet Benchmarking Data (2023-2025)

- EVC Driver Sentiment Survey, June 2024

- Manufacturer Range Estimates (2024 Models)

This Article First Appeared At www.automotive-fleet.com