The three fleet segments showed sales gains for the month of December 2025.

Industrial, rental, and government fleet sales hit a collective post-pandemic high in 2025, recovering from a dip in 2024, based on figures released by Bobit Business Media on Jan. 5.

2025 fleet sales numbered 2,227,876, up 4.8% over 2,125,441 in 2024. 2025 sales also exceeded the two,179,751 vehicles sold in 2023.

Credit for the recovery goes to rental fleet sales, which reached 1,206,713 cars in 2025, up 16.4% from 1,036,830 in 2024. Rental cars accounted for 54% of total fleet sales in 2025.

The rental segment contrasts sharply with industrial fleet sales, which fell 4% last 12 months. 2025 sales dropped to 781,986 industrial fleet vehicles, down from 814,391 in 2024.

“The industrial segment saw declines in 2025, after post-pandemic pent-up demand had already been satisfied, impacting growth in industrial,” said Zohaib Rahim, senior manager of economic and industry insights for Cox Automotive. “Trade and tariff uncertainty could have caused among the earlier declines we saw within the segment; nevertheless, much like the rental segment, performance improved the second half of 2025 with the passing of the One Big Beautiful Bill Act (OBBBA), but it surely was not enough of a lift to guide to year-over-year gains in sales.”

One vivid spot within the industrial segment was truck sales, which rose 9% 12 months over 12 months, Rahim said. Meanwhile, automobile volume was down 13% through the same time period and accounted for under 14% of total fleet sales for the 12 months.

Government fleets recorded the bottom sales in 2025, down 12.8% to 239,177 vehicles sold, from 274,220 in 2024.

Despite the 2025 uptick, combined fleet sales across the industrial, rental, and government segments lingered below pre-pandemic levels (2019), down around 20% in 2025, Rahim said. He attributed many of the half-decade decline in sales to the rental segment, still below 2019 levels.

December A Good Month For Fleet Segments

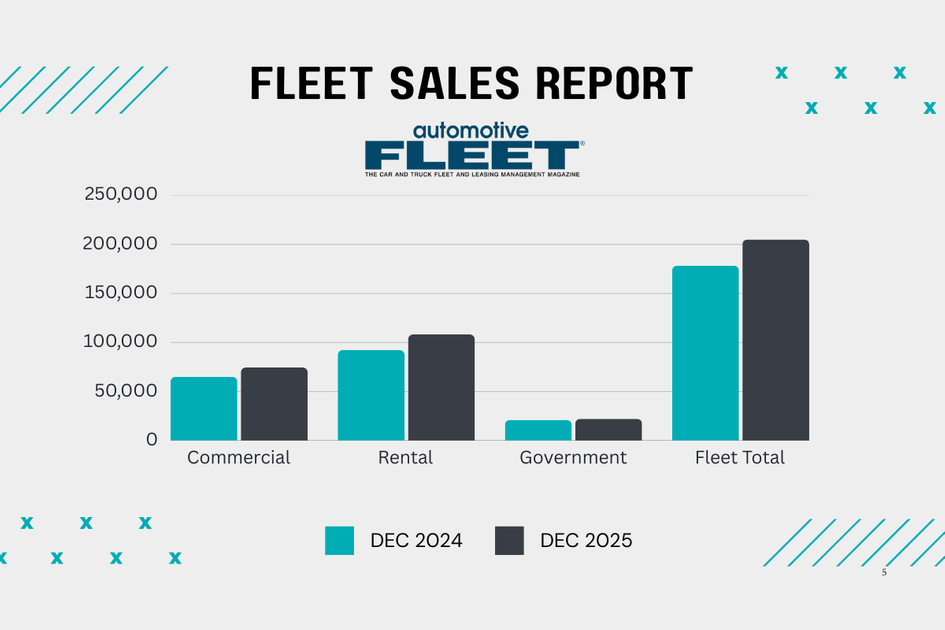

While the annual fleet scene was split, all three fleet segments showed sales gains for the month of December 2025, a rarity for the 12 months:

- Industrial fleet sales rose to 74,543 vehicles from 64,978 in December 2024, up 14.7%.

- Rental fleet sales barreled up 17.1% for the month, from 92,386 rental cars sold in 2024 to 108,216 vehicles sold last 12 months.

- Government fleet vehicles, which fared the worst of the three fleet sectors throughout 2025, ended the 12 months on a stronger note, with 22,242 vehicles sold in December, up 5.8% from 21,031 in December 2024.

That resulted in total December fleet sales of 205,001, up 14.9% from 178,395 fleet vehicles sold in December 2024.

December fleet volume increased 15% year-over-year, with truck sales up 17% for the month in comparison with last 12 months, Rahim said. Fleet sales continued their positive momentum and gains in December, after increasing 18% 12 months over 12 months in November, he added.

2024 Fleet Sales Review

Total U.S. fleet vehicle sales eased by 2.5% in 2024 as OEMs met demand from fleet operations which have since restored fleet sizes after the pandemic, which constricted supply, based on Bobit/Automotive Fleet sales data.

Rental and government fleet vehicles showed slight gains for 2024, which wasn’t enough to offset the larger decline in industrial fleet vehicles sold.

Rental fleet vehicles comprised almost half of all fleet vehicle sales in 2024.

Across industrial, rental, and government fleets, total sales in 2024 reached 2,125,441 vehicles, up from 2,179,751 in 2023 and 1,698,656 in 2022. That represents a 2.5% decrease over 2023 but a 20% increase over 2022.

Waiting for 2026, Cox Automotive anticipates a decline in fleet sales compared with 2025, as slower economic growth limits demand and weakens the industrial and rental segments, Rahim said. “Those also occur to be the most important segments of fleet. Supply needs to be relatively stable, because the headwinds are demand-driven.”

This Article First Appeared At www.automotive-fleet.com