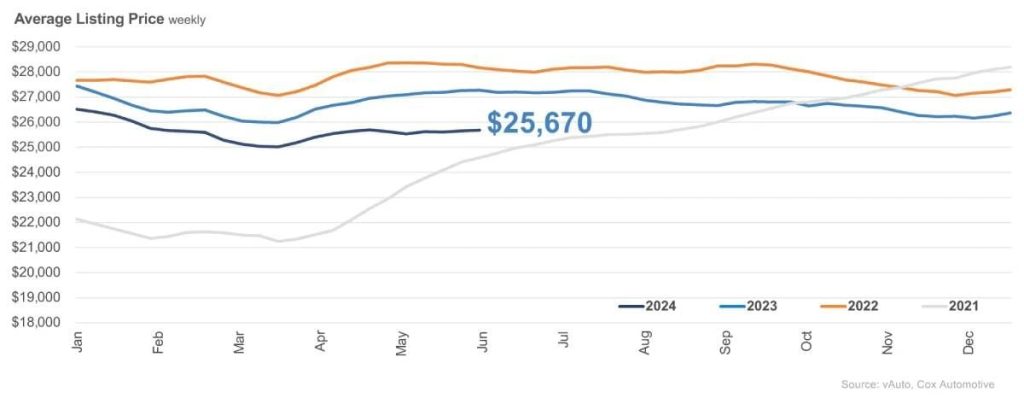

The typical used-vehicle listing price was $25,670, up barely from the revised $25,534 in the beginning of May but down 6% from a yr earlier.

Used-vehicle inventory levels in the beginning of June were barely lower than in May, in response to an evaluation of Cox Automotive’s vAuto Live Market View data released June 14, as sales picked back up in May after a slowdown in April following an unexceptional tax refund season.

The overall supply of used vehicles on dealer lots – franchised and independent – across the U.S. was at 2.26 million units as June opened, up 3% from a yr ago but barely lower than the two.27 million units in the beginning of May.

The market saw a rise in sales for each recent and used vehicles in May. Inventory levels of latest increased through May but decreased for used. (Examine new-vehicle inventory.) Used-vehicle days’ supply in the beginning of June was 45 days, compared with the revised 48 days in the beginning of May, and lower by 8% against last yr.

The Cox Automotive days’ supply is predicated on the estimated every day retail sales rate for probably the most recent 30-day period, when sales were 1.51 million units. Used-vehicle sales within the period were up greater than 12% yr over yr.

The typical used-vehicle listing price was $25,670, up barely from the revised $25,534 in the beginning of May but down 6% from a yr earlier. Retail used-vehicle prices have been consistently lower through the primary five months of 2024 in comparison with year-ago levels.

Used cars below $15,000 proceed to indicate constrained availability with only 34 days’ supply, 22% lower than the common. Affordability stays difficult for consumers, and provide is more limited at cheaper price points. The highest five sellers of the month sold at a median price of $23,999, about 7% below the common listing price for all vehicles sold, and were once more Ford, Chevrolet, Toyota, Honda and Nissan, accounting for 52% of all used vehicles sold.

This Article First Appeared At www.automotive-fleet.com