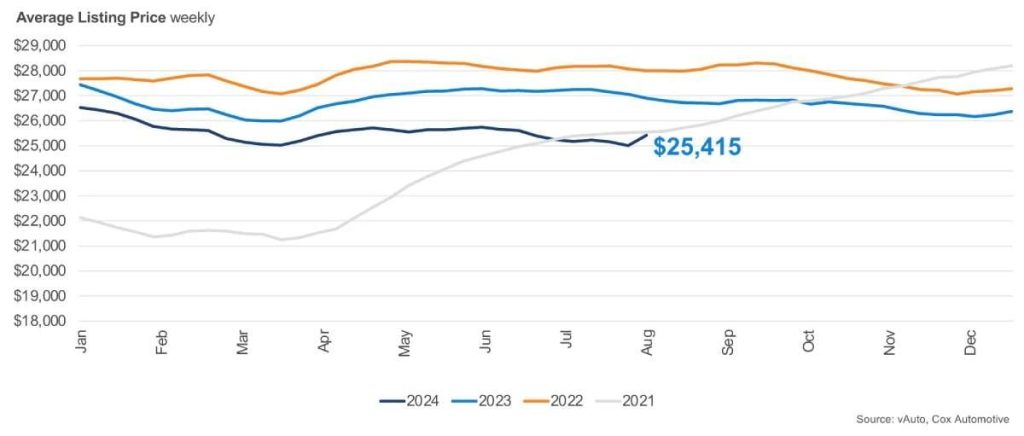

The typical used-vehicle listing price was $25,415, up from the revised $25,246 initially of July but down 5% from a 12 months earlier.

Used-vehicle inventory levels initially of August were lower than in July and down 3% from this time last 12 months, in keeping with the Cox Automotive evaluation of vAuto Live Market View data released Aug. 16.

As August opened, the whole supply of used vehicles on dealer lots – franchised and independent – across the U.S. was at 2.17 million units, down from the two.22 million units initially of July.

The dealer management system (DMS) outage that disrupted sales and inventory reporting over the previous month continues to create volatility in reporting. As of June 30, the impacts ended up inflating days’ supply levels and lowering sales, and that’s now unwinding and delivering much variability for those data series but in the opposite direction as the complete picture July.

The market saw a big increase in sales for each recent and used vehicles, most notably at the top of the month, which drove measures of days’ supply lower. Although Cox estimates a rise in used retail sales for July in comparison with June, the disruption continues to make it difficult to offer an accurate report, with the reality for each months probably somewhere in between.

Inventory levels of each recent and used vehicles decreased through July. Nevertheless, the outage appears to have had less of an impact on the used-vehicle market. Used-vehicle days’ supply initially of August was 41 days, down 12 days from the start of July and down seven days from last 12 months.

The Cox Automotive days’ supply relies on the estimated each day retail sales rate for probably the most recent 30-day period, when sales were 1.6 million units. Used-vehicle sales within the period were up 27% month over month and nearly 15% 12 months over 12 months.

The typical used-vehicle listing price was $25,415, up from the revised $25,246 initially of July but down 5% from a 12 months earlier. The rise in the typical listing price was mostly as a consequence of a mixture shift where the variety of 0-to-2-year-old vehicles made up a bigger portion of the vehicles sold. Retail used-vehicle prices have been consistently lower through the primary seven months of 2024 in comparison with year-ago levels and are actually down below where they were at the identical time in 2021.

Nevertheless, affordability stays difficult for consumers, and provide is more constrained at cheaper price points. Used cars below $15,000 proceed to point out low availability, with only 31 days’ supply, 29% lower than the market total. The highest five sellers of the month were listed at a mean price of $23,922, about 6% below the typical listing price for all vehicles sold. Once more, Ford, Chevrolet, Toyota, Honda and Nissan were the top-selling automakers, accounting for 51% of all used vehicles sold.

This Article First Appeared At www.automotive-fleet.com