J.D. Power’s latest 2025 Automotive Performance, Execution and Layout (APEAL) Study is in, and it paints a reasonably optimistic picture of how Americans feel about their latest cars. Now in its thirtieth yr, the APEAL Study has turn into a barometer for the way emotionally connected new-vehicle owners feel about their purchases. This yr’s report shows a notable uptick in satisfaction across the board, with every category improving for the primary time in nearly a decade.

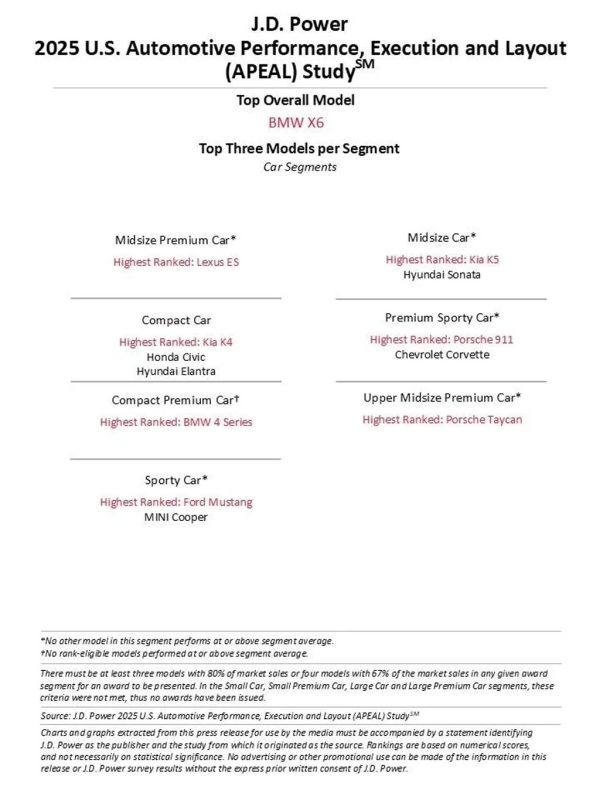

For the second yr in a row, Porsche and Mini top the rankings of their respective Premium and Mass Market segments. Porsche’s enduring appeal with buyers lies within the brand’s holistic approach to performance, design, and luxury, while Mini continues to win hearts with its character-rich styling and playful driving dynamics. BMW also grabbed headlines with the X6 earning the highest rating amongst individual models, edging out last yr’s winner, the 7 Series. While some might call the X6’s coupe-SUV silhouette polarizing, clearly its fans appreciate the daring design.

The APEAL Study is designed to measure a buyer’s satisfaction throughout the critical first 90 days of ownership. It doesn’t give attention to problems or reliability issues, that are covered in other J.D. Power studies. As a substitute, it hones in on the emotional connection owners have with their vehicles, evaluating 37 distinct attributes starting from performance and styling to comfort and usefulness.

A standout finding this yr was the sharp increase in satisfaction with fuel economy. That metric saw a 13-point jump, the best gain in any category. It’s a signal that automakers are hitting the mark on the subject of efficiency without compromising the general ownership experience. Infotainment and interior design also saw respectable gains, each improving by six points, reflecting the growing importance of tech and tactile quality to modern buyers.

Amongst Premium brands, Land Rover, Jaguar, Rivian, and Tesla ranked high, suggesting their loyal followings are still very much engaged. Surprisingly, legacy luxury names like Audi, Lexus, Volvo, Acura, and Infiniti didn’t perform as well. Enthusiasm appears to be waning for models just like the Audi Q5, a vehicle that arguably plays it a bit too secure in a segment full of flashier alternatives.

Within the Mass Market arena, Dodge and GMC followed closely behind Mini, showing strong emotional resonance with buyers. Nonetheless, the competition here was much tighter, with less separation between brands. That tight grouping made among the lower scorers more surprising, especially Mazda, Subaru, and Jeep. These are brands known for passionate followings, yet their scores suggest some owners could also be underwhelmed. Infotainment quirks in Mazda and Subaru models could possibly be one explanation, while Jeep’s give attention to rugged, off-road utility might trade off some on a regular basis comfort and refinement.

One other insight from this yr’s study: vehicles of their first model yr are inclined to rating lower on emotional satisfaction. J.D. Power attributes this to early-stage tech bugs and system gremlins that always plague fresh redesigns. Buyers of carry-over models, alternatively, appear to develop a stronger emotional bond, likely resulting from the predictability and polish of a known quantity.

Customization can be becoming a key factor. The study found that 55% of homeowners created user profiles of their vehicles, where possible, allowing them to personalize and save settings like seat position, climate preferences, and audio configurations. Those that used these profiles reported notably higher satisfaction scores, further confirming that tailored experiences are what many drivers want.

As for model-level wins, BMW had a robust showing with the X1, X4, 4 Series, X6, and even the Mini Countryman topping their respective segments. Hyundai Group wasn’t far behind, with wins for the Santa Fe, Santa Cruz, Kia K4, and K5, underscoring the Korean automakers’ growing influence and give attention to design and execution.

With nearly 93,000 latest vehicle owners weighing in, the 2025 APEAL Study doesn’t just tell us which cars people like. It reveals what truly matters to modern automotive buyers: emotional connection, thoughtful design, reliable tech, and fuel efficiency. In a market where selections are more plentiful than ever, the brands that may tap into those emotional triggers will proceed to return out on top.

FOLLOW US TODAY:

Mike Floyd is a finance executive by trade and a automotive enthusiast at heart. As a CFO with a keen eye for detail and strategy, Mike brings his analytical mindset to the automotive world, uncovering fresh insights and unique perspectives that transcend the surface. His passion for cars—especially his favorite, the Porsche 911, fuels his contributions to Automotive Addicts, where he blends a love for performance and design along with his skilled precision. Whether he’s breaking down industry trends or spotlighting emerging innovations, Mike helps keep the positioning each sharp and forward-thinking.

This Article First Appeared At www.automotiveaddicts.com