Total sales over the primary six months of the 12 months reached 3.41 million units, an 8% increase in comparison with 2023’s YTD total.

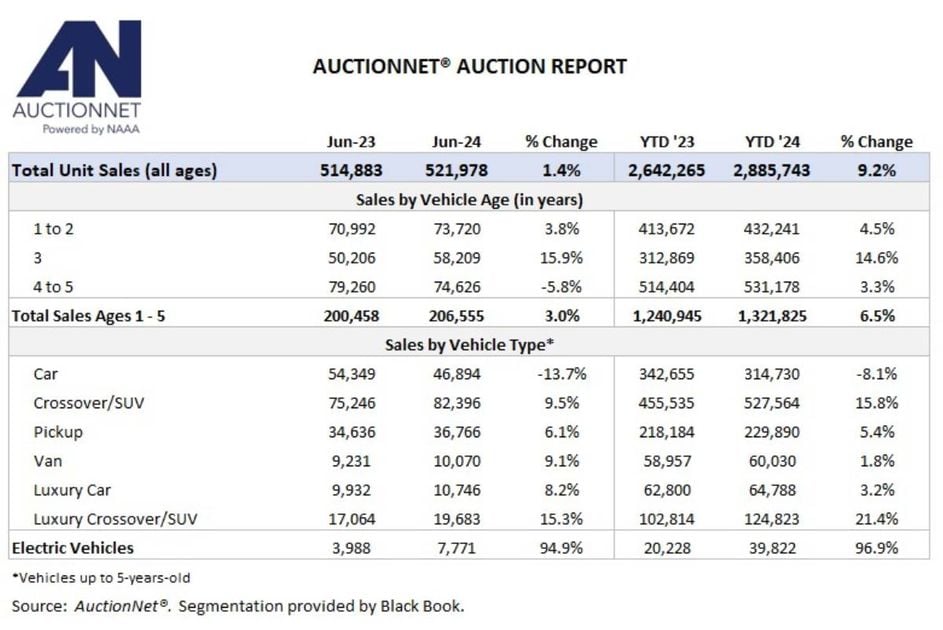

AuctionNet wholesale vehicle auction sales got here at about 522,000 vehicles in June, up a small 1.4% versus June 2023 but down nearly 14% from May 2024, in line with data released July 12 from the National Auto Auction Association.

But there have been two fewer selling days this 12 months than in June 2023 and May 2024, and after accounting for this difference, sales were 11.5% higher on a prior-year basis and were down a lesser 5% in comparison with May.

For the primary time, monthly figures reflect all sales, not only fleet/lease sales, as they did within the previous monthly releases on account of underlying changes in how the information is reported, said Larry Dixon, vice chairman of Auction Data Solutions/AuctionNet.

Total sales over the primary six months of the 12 months reached 3.41 million units, an 8% increase in comparison with 2023’s YTD total. Auction sales of later model units (as much as 5 years old) also rose through June by a smaller 6.5%.

Dealer and business sales finished the month up 2% and 29%, respectively, in comparison with last June (selling day adjusted). Yr-to-date, the primary half of the 12 months closed with business sales up 28.7% and dealer sales down 4.2%.

Following the pandemic-era supply constraints, starting in late 2022 business fleets were capable of acquire more recent vehicles, which in turn means they’ve been remarketing more such vehicles over the past six-plus months, Dixon said. And rental fleet corporations have been working to right-size their fleets based on current demand levels, which has contributed to the variety of vehicles they’ve remarketed, he said.

Due partially to the expansion in recent vehicle lease originations that occurred over the primary a part of 2021, nearly 15% more 3-year-old vehicles were sold over the primary half of the 12 months relative to 2023.

Off-lease auction sales have been temporarily spiking this 12 months due to the high volume of leases in the primary half of 2021, Dixon said. That said, lease originations fell acutely over the second half of 2021, which suggests that 3-year-old off-lease volume will follow an analogous pattern over the back half of this 12 months.

Not accounting for differences in selling days, later model sales were higher year-over-year in June for all vehicle types save for mainstream cars where volume was down by 13.7% (the selling-day adjusted difference was 5.1%). Conversely, CUV and SUV sales continued to trend higher, led by a greater than 15% rise in luxury CUV/SUV sales.

Ford and Nissan dominated the highest selling fleet models in June, while Tesla and Cadillac prevailed in the luxurious segment.

Collectively, later model crossover and SUV auction sales were up 18.6% over the primary half of 2024, while full-size pickup sales moved 5.4% higher. Reflecting the long-running decline in recent vehicle sales, there was an 8% drop in later-model mainstream automotive sales over the period.

As for EVs, data shows continued strong growth within the number of electrical vehicles rolling through the lanes in June, with sales up nearly 95% in comparison with last 12 months. Greater than 39,800 later model EVs were sold at participating AuctionNet auctions over the primary half of the 12 months, representing a virtually 19,600 unit, or 97%, increase versus 2023.

“Because recent electric vehicle sales have grown acutely from a low floor over the past several years, the trend is now occurring within the used/auction markets, as recent sales beget used sales,” Dixon said. “Since EVs are heavily leased, they may enter the used market prior to in the event that they were purchased.”

Monthly AuctionNet data is derived from 265 NAAA member auctions that use AuctionNet. It is taken into account essentially the most comprehensive source of wholesale auto auction sales data within the U.S.

This Article First Appeared At www.automotive-fleet.com