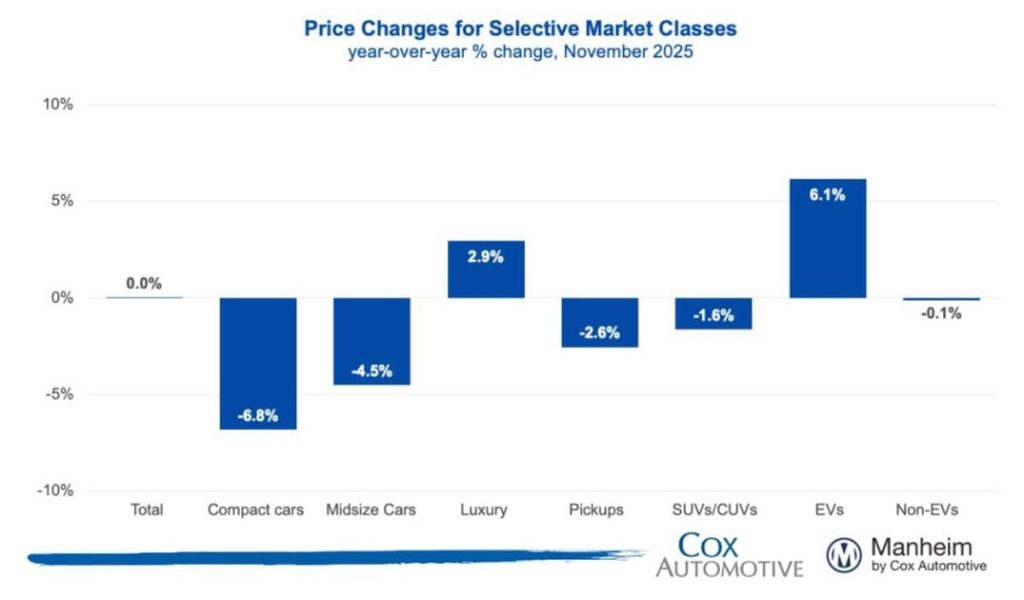

Overall market prices were flat yr over yr, with luxury vehicles posting the biggest increase and compact cars recording the biggest decline.

The Manheim Used Vehicle Value Index (MUVVI) rose to 205.4, reflecting a 1.3% increase in November’s wholesale used-vehicle prices (adjusted for mix, mileage, and seasonality) in comparison with October.

The index is usually unchanged from November 2024. The long-term average monthly move for November is a decrease of 0.6%.

Non-adjusted wholesale vehicle prices fell 0.3% from October and at the moment are flat yr over yr, giving back a few of the strength observed throughout most of this yr. The long-term average monthly move in non-adjusted values is a decline of 0.4% in November.

“Like most metrics we track across the automotive landscape, wholesale prices dipped in October before showing modest improvement in November,” said Jeremy Robb, chief economist for Cox Automotive, in a Dec. 8 news release. “As November progressed, each recent and used retail sales lifted from October levels, and the longest government shutdown in history ended.

“While consumer sentiment stays subdued, early reads suggest confidence is recovering. We’re seeing good vehicle sales supported by lower APR rates, and price depreciation is trending back to normal, with values barely higher than usual. We’re also only a month from January, when lower tax withholding rates will boost take-home pay. Once consumers feel that of their paychecks and realize their tax refunds could possibly be substantially higher this yr, we predict some tailwinds to hit the auto market.”

MMR Prices, Retention, and Sales Conversion

MMR prices declined barely greater than the everyday 1.7% for this era, however the trend eased because the month progressed. Although MMR retention decreased somewhat, it stays generally according to expectations for this time of yr.

Meanwhile, sales conversion indicates a modest strengthening of demand, with conversions higher than usual for this time of yr.

- MMR prices for the Three-Yr-Old Index declined 1.9% in November.

- MMR retention averaged 98.9% in November, down 0.1 percentage points from October and 50 basis points yr over yr.

- Sales conversion was 57.2% for the period, up 2.9 percentage points from October and 5.2 percentage points higher than probably the most recent three-year average.

YOY Price Changes In Vehicle Segments

Overall market prices were flat yr over yr, with luxury vehicles posting the biggest increase and compact cars recording the biggest decline.

Most vehicle segments remain lower against last yr; nonetheless, we proceed to see the luxurious segment outperforming the general market. We’ve got observed the strength on this segment for several months, because it is more influenced by higher EV prices. Compact and midsize cars proceed to see large declines in comparison with last yr.

EV versus Non-EV Index

With the expiration of government-backed EV incentives, market pricing dynamics shifted. Essentially, the retail prices of many recent and used EVs rose when incentives and the “leasing loophole” were removed, forcing dealers to supply lower prices to take care of demand.

- EVs: The Electric Vehicle (EV) Index was up 2.3% from October (post EV tax credit expiration), and up 6.1% yr over yr.

- Non-EVs: The Non-EV Index was up 1.3% from October and down 0.1% yr over yr.

Wholesale Supply And Rental Prices

Before the pandemic, wholesale used-vehicle supply averaged 32 days at the tip of November, typically rising into year-end as seasonal aspects played out. This yr, wholesale supply rose over the month, as is common, while holiday periods slowed the pace of sales.

- Wholesale supply: At the tip of November, wholesale days’ supply rose to 30.1 days, higher by 2.2 days in comparison with October, and better by 1.3 days yr over yr

- Rental prices: Prices for rental vehicles declined in November, falling by 4.3% from October. Non-seasonally adjusted values for Rental units are down 3.3% yr over yr, while average mileage is down 9.1% yr over yr.

This Article First Appeared At www.automotive-fleet.com