Automotive

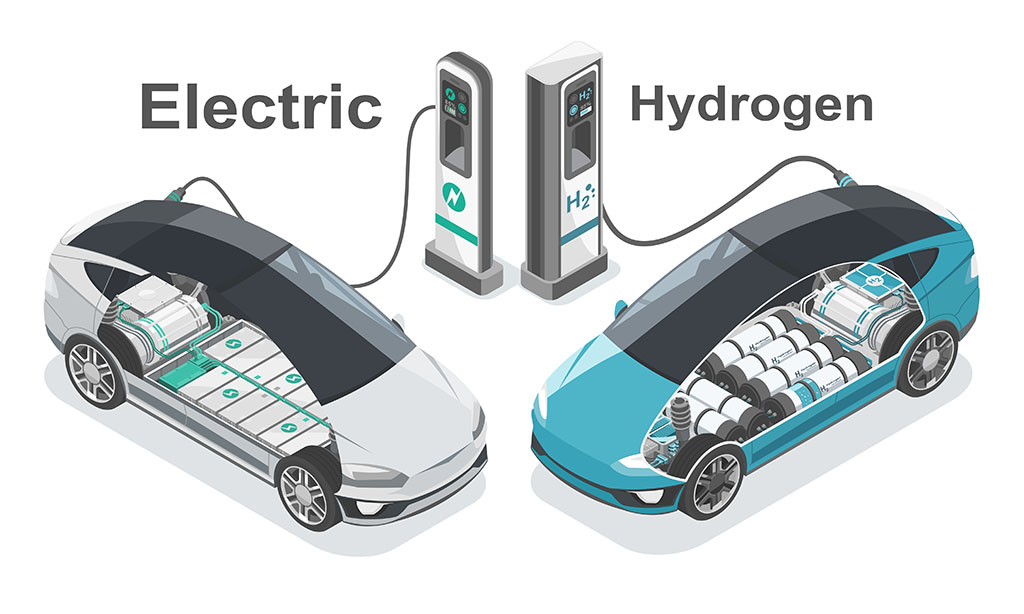

Because the automotive industry accelerates toward sustainable solutions, the controversy between hydrogen fuel cell vehicles (FCEVs) and battery electric vehicles (BEVs) intensifies. Each technologies aim to cut back emissions, yet they differ significantly in infrastructure, efficiency, and market adoption.

Electric vehicles have seen remarkable growth, with global sales nearing 14 million in 2023, a 35% increase from the previous 12 months. This surge is primarily driven by China, Europe, and america, which together account for 95% of those sales.

Despite this momentum, challenges persist, including high costs, range anxiety, and insufficient charging infrastructure, particularly within the U.S. and Europe.

Are Hydrogen Fuel Cell Vehicles An Emerging Contender?

Hydrogen FCEVs, corresponding to the Toyota Mirai and Hyundai Nexo, offer quick refueling times and longer driving ranges, appealing to consumers looking for convenience. Nonetheless, their adoption is hindered by limited refueling infrastructure and better vehicle costs. In 2023, fewer than 3,000 hydrogen cars were sold within the U.S., highlighting their area of interest status in comparison with the burgeoning EV market.

BEVs convert roughly 80% of their energy into vehicle movement, whereas FCEVs achieve lower than 40% efficiency.

This disparity makes BEVs more energy-efficient. Nonetheless, hydrogen cars emit only water vapor, offering an eco-friendly alternative with the potential for zero emissions, provided the hydrogen is produced sustainably.

Infrastructure and Market Adoption

The expansion of charging networks has bolstered BEV adoption, with substantial investments enhancing accessibility. Conversely, the scarcity of hydrogen refueling stations limits FCEV growth. Regions like Asia are advancing in hydrogen infrastructure, but Europe and the U.S. lag, affecting consumer confidence and vehicle uptake.

The Road Ahead

Automakers are exploring each technologies to fulfill diverse consumer needs and regulatory demands. BMW, as an example, is developing hydrogen FCEVs in partnership with Toyota, aiming for a 2028 release.

This strategy suggests a future where BEVs and FCEVs coexist, each serving specific market segments.

While BEVs currently lead the charge toward sustainable transportation, hydrogen FCEVs present a promising alternative, especially for applications requiring rapid refueling and prolonged range. The evolution of each technologies, alongside supportive infrastructure and policies, will determine their roles within the automotive landscape. For consumers, the alternative between hydrogen and electric vehicles hinges on individual needs, environmental considerations, and the supply of refueling or charging options.

FOLLOW US TODAY:

This Article First Appeared At www.automotiveaddicts.com