The highest five selling latest EV models, ranked by sales volume, were the Tesla Model Y, Model 3, Volkswagen ID.4, Tesla Cybertruck, and Honda Prologue, making up 54% of total EV sales for the month.

The electrical vehicle market thrived across latest and used segments in January with robust sales and pricing amid declining days’ supply.

Propelled by continuing consumer interest, the used EV market grew, driven by affordability and more model options. Days’ supply and average transaction prices (ATPs) further highlighted the shifting landscape of the EV market.

EV Sales Up at a Healthy Clip

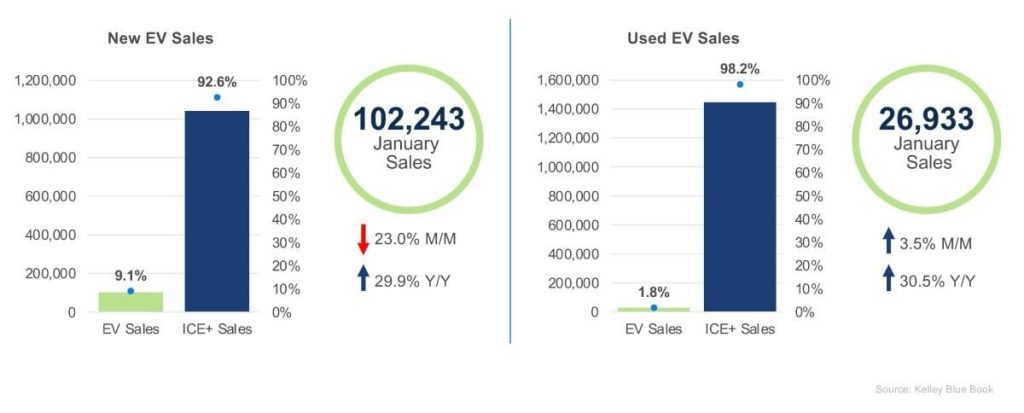

Latest EV Sales: In January, latest electric vehicle sales volume reached 102,243 units, up 30% 12 months over 12 months. January marked the tenth consecutive month with over 100,000 units sold. Following a record month in December, when U.S. EV sales reached the very best level ever, a month-over-month sales decline was expected. The highest five selling models, ranked by sales volume, were the Tesla Model Y, Model 3, Volkswagen ID.4, Tesla Cybertruck, and Honda Prologue, making up 54% of total EV sales for the month. Volkswagen ID.4 had a comeback month, with sales up 653% to achieve 4,979 vehicles.

Used EV Sales: Used electric vehicle sales increased by 3.5%, reaching 26,933 units, marking the second-highest volume. This represents a 30.5% year-over-year growth and a market share of 1.8%. The highest five selling brands, ranked by sales volume, were Tesla, Chevrolet, Mercedes-Benz, Ford, and Nissan, with Mercedes-Benz showing a 54% month-over-month increase in volume. The highest-selling models were the Tesla Model 3, Model Y, Model S, Chevrolet Bolt, and Ford Mustang Mach-E.

Yearly Days’ Supply Tightens

Latest EV Days’ Supply: In January, the brand new EV days’ supply increased by 5.3% month over month, reaching 87 days. Despite this rise, it stays below the times’ supply for internal combustion engine (ICE) vehicles. 12 months over 12 months, the availability of latest EV days is down 35.1%, indicating an enormous improvement in inventory turnover in comparison with the previous 12 months. Volkswagen experienced the most important decline, while Lexus saw the most important increase in days’ supply month over month.

Used EV Days’ Supply: The availability of used electric vehicles continued to tighten to 45 days’ supply, decreasing by 3% month over month and 23.3% 12 months over 12 months. This high demand is possibly driven by aspects reminiscent of the affordability of used EVs, the supply of tax incentives for a lot of models, and more consumers realizing that EVs can meet each day driving needs. Moreover, many used EVs include battery warranties, providing extra peace of mind for buyers.

Incentive spending on EVs decreased by 3.1% in comparison with December but was higher by 48.6% 12 months over 12 months.

EV Prices Hold Straddle Regular Levels

Latest EV Average Transaction Price: In January, the common transaction price (ATP) for brand spanking new electric vehicles was $55,614, a 0.9% increase from the previous month and a 1.4% decrease from the previous 12 months. Incentive spending on EVs decreased by 3.1% in comparison with December but was higher by 48.6% 12 months over 12 months. The manufacturers with the very best incentive levels were Volkswagen, Subaru, Kia, and Nissan – with a mean of 36.2% of ATP.

Used EV Average Listing Price: The typical listing price for used electric vehicles was $37,476, showing a 1.7% increase month over month and a 5.1% decrease 12 months over 12 months. Ten brands (Porsche, Toyota, Chevrolet, Jaguar, Mazda, Volvo, Mini, Lexus, Nissan, and Subaru) had listing prices at or below those of their internal combustion engine (ICE+) models. Moreover, 39.4% of units sold were priced under $25,000.

This Article First Appeared At www.automotive-fleet.com