Over the past yr, Hyundai has gained essentially the most days’ supply, up 38 days yearly, while Jeep and Ram have dropped essentially the most, down 54 and 56 days, respectively.

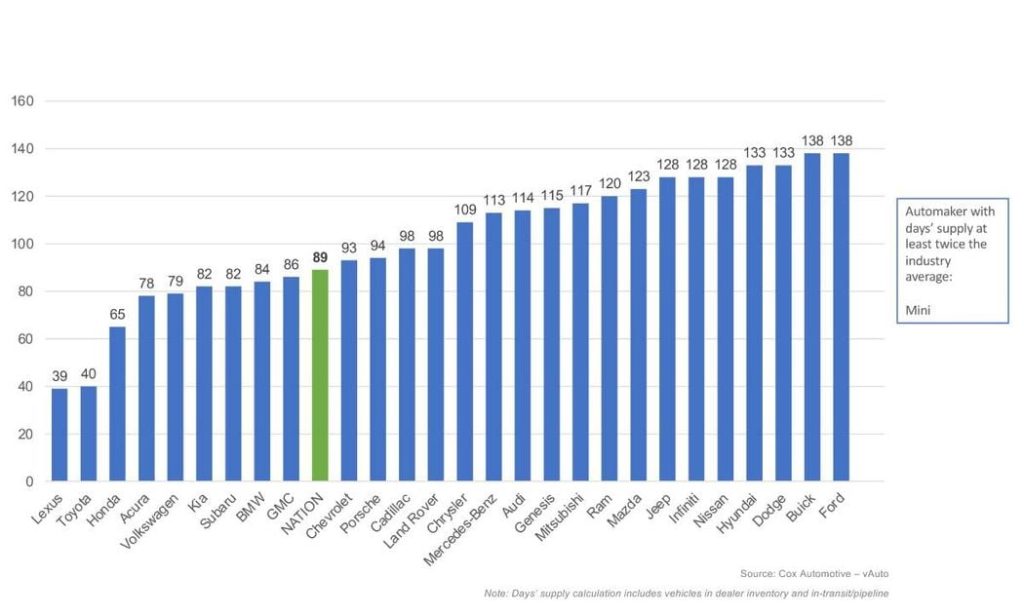

With a warmer sales pace in February, new-vehicle days’ supply dropped to 89 days, a ten% decrease in comparison with the beginning of February, in keeping with vAuto Live Market View data released March 13.

While concerns about future price increases could also be driving more customers to the showroom, uncertainties in policy changes are creating challenges for automakers as they await further information. Over the past yr, Hyundai has gained essentially the most days’ supply, up 38 days yearly, while Jeep and Ram have dropped essentially the most, down 54 and 56 days, respectively.

It points to February as a solid month for brand new vehicle sales. The 30-day sales pace increased by 13.6% in comparison with January and rose 5.9% yearly. At first of March, the full U.S. supply of obtainable unsold latest vehicles was 2.99 million units, reflecting a 2.2% increase from the beginning of February and a 12.8% increase from a yr ago. With greater inventory availability, dealers had market confidence, and consumers had loads of options when selecting a brand new vehicle.

Toyota, Ford, Chevrolet, Honda, Hyundai, and Kia were again the six best sellers in February, accounting for 58% of all sales and 53% of all vehicle inventory. While the typical listing price of all sales is $48,316, these six best sellers averaged $42,524. As rates of interest proceed to rise, difficult affordability, these six manufacturers offer over 40 models listed below that average listing price, with a further 50 models at or below this price.

Available unsold inventory of vehicles with a mean listing price at or below $20,000 declined 17% month over month, while vehicles with a mean listing price at or above $80,000 increased by 9% month over month. The industry continues to depend on higher-income households to drive the brand new vehicle market, and the concentrate on high-end vehicles is evident. In February, 41% of inventory in the very best price category (over $80,000) were priced at $100,000 and above. In truth, at first of March, greater than 75,000 latest vehicles were available with price tags of greater than $100,000. A yr ago, there have been fewer than 50,000.

Month after month, compact SUVs and full-size pick-ups remain top sellers, and there was little change in the combo of vehicles sold and types carrying above-average inventory levels. Given proposed policy changes, especially on tariffs that might most impact cheaper vehicles, the market can expect shifts that mirror current trends.

Fueling the brand new vehicle market is the tax season, which is off to a robust start, with 28% of all refunds issued totaling $102.25 billion, a ten% increase from last yr, in keeping with essentially the most recent data available on Feb. 21. The common refund has risen 7% yr over yr to $3,453, providing a giant money boost to Predominant Street USA. Moreover, annual bonuses, typically paid in the primary few months of the yr, are likely contributing to the influx of funds for brand new vehicle buyers. Nevertheless, in February, consumer confidence took successful amid news cycle chaos, including tariff threats and rising prices, resulting in the bottom level of car purchase plans since last February.

Latest-Vehicle Pricing Declines in February

The common listing price for a brand new vehicle in the most recent report was $48,316, down 0.6% from a month earlier and better by 2.6% in comparison with last yr. Nevertheless, 82 models in the marketplace are priced at $40,000 and below, and 31 sit below the $30,000 mark.

The Mitsubishi Mirage stays the last vehicle with a mean listing price under $20,000, with the Mirage G4 priced at $19,731 because the model is on a sell down. The following closest competitor, the Nissan Versa, is available in at $20,149 with 103 days’ supply, followed by the outgoing Kia Forte at $22,085 with 56 days’ supply.

As reported earlier this week, the average transaction price (ATP) of a brand new vehicle within the U.S. in February was $48,039, a slight decline from January but a rise of 1.0% from year-ago levels. In February, new-vehicle sales incentives held regular at 7.1% of ATP, or roughly $3,392.

This Article First Appeared At www.automotive-fleet.com