Auction sales of vehicles as much as 2 years old were nearly 30% higher this September than they were last 12 months, and sales for the group were also nearly 9% higher than in August.

Wholesale auction sales continued to outpace year-ago levels in September, with sales up 5.5% on a selling-day adjusted basis in comparison with September 2024, in response to AuctionNet data released Oct. 13.

Nevertheless, sales fell 1.6% from August, which marked the primary monthly decline recorded since June.

Sales over the third quarter of the 12 months were 6% higher than in Q3 2024, and sales through the primary nine months of the 12 months were nearly 6% higher than over the period in 2024.

Industrial activity continued to power sales growth last month, with business sales nearly 16% higher than in September 2024 and 5% higher than in August. But dealer sales fell 5% versus August and were 3% lower on a prior-year basis. Dealer sales have fallen on each a prior-year and a monthly basis for 2 months in a row.

Costlier electric vehicles dominated the highest five selling luxury models at auto auctions in September.

Sales of Used Units Mixed

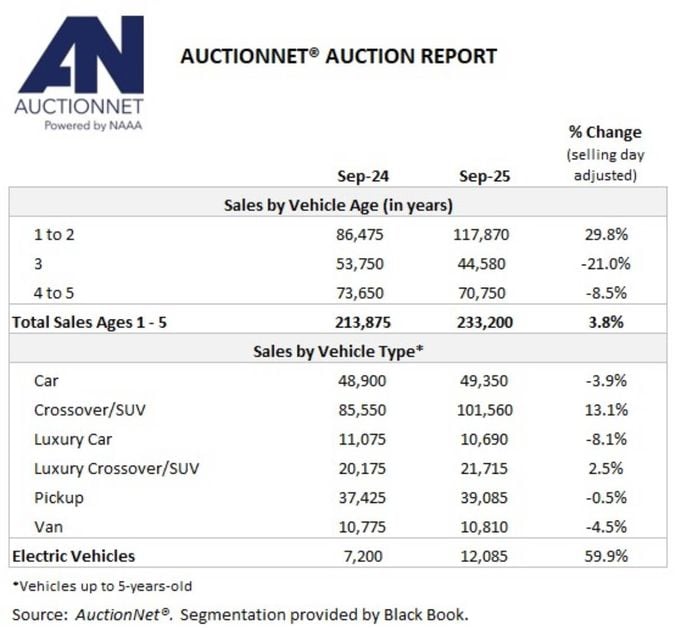

Auction sales of vehicles as much as 2 years old were nearly 30% higher this September than they were last 12 months, and sales for the group were also nearly 9% higher than in August (selling day adjusted).

By comparison, sales of 3-year-old units, which include a big mixture of off-lease vehicles, were 21% lower last month on a prior-year basis and down 5% in comparison with August. Industrial sales of 3-year-old units were nearly 21% lower in September versus last 12 months.

The industry should see more 3-year-old volume next 12 months, given the advance in recent vehicle lease activity that occurred in 2023. Recent vehicle leases grew by about 14% year-over-year in 2023, and most recent vehicle leases are for a 36-month term.

Sales of 4-to-5-year-old units also continued to trend lower last month, dropping 8.5% versus last September and nearly 4% in comparison with August.

As for segments, few material changes occurred in longer-running trends last month: Auction sales of more cost-effective mainstream cars continued to maneuver lower, while sales of utility vehicles moved higher on a prior-year basis.

- Total electric vehicle sales exceeded 119,000 units over the primary 9 months of the 12 months, surpassing 2024’s full-year figure of 109,300 units (+48% on a selling day adjusted basis).

- Hybrid sales are up 18% year-to-date and used price retention is superior to comparable ICE and EV models, on average. For context, 3-year-old retention for EV models averaged 37.2% in September, while hybrid retention averaged 66.6%.

- Wholesale prices for 2-to-8-year-old vehicles averaged $18,400 in September, down 2.1% from August but 5.1% higher than in September 2024.

- From a depreciation standpoint, wholesale prices are down just 4% in comparison with January; for context, depreciation was 7% over the primary 9 months of 2024 and was greater than 10% in 2023.

Monthly AuctionNet data is derived from 265 National Auto Auction Association member auctions that use AuctionNet, and is taken into account probably the most comprehensive source of wholesale auto auction sales data within the U.S.

This Article First Appeared At www.automotive-fleet.com