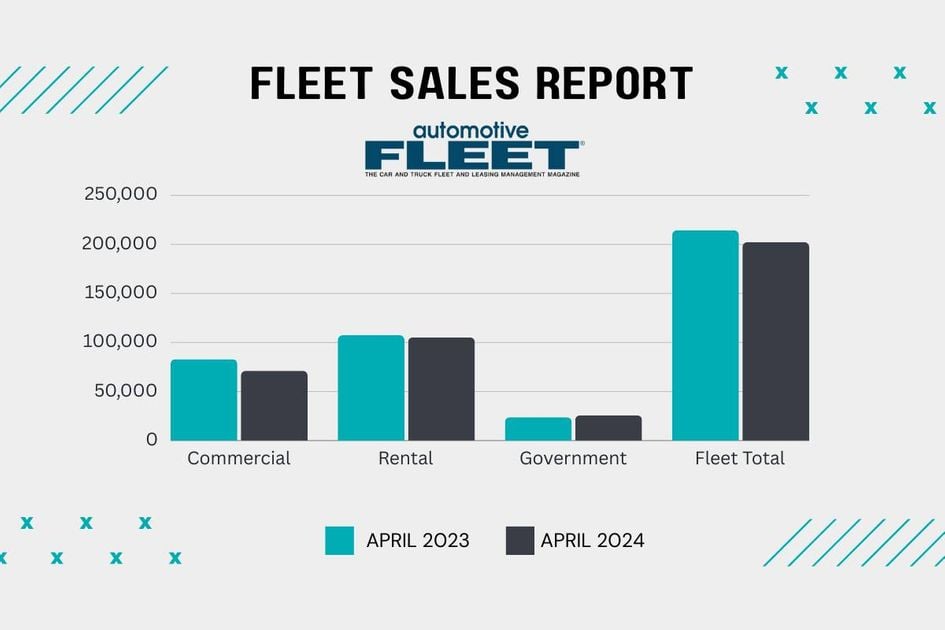

In sum, total April 2024 fleet sales stood at 202,309, down 5.6% from 214,362 in April 2023. To date in 2024, total monthly fleet sales have fallen year-over-year in March and April, while rising in January and February.

In recent months, the three primary fleet sectors each have lurched amongst gains and losses in fleet vehicle sales, with one among them no less than signaling a recovering fleet market while one or two others deviate from that trend.

For April, government fleet sales rose at a moderate pace, while industrial fleet sales fell at its highest rate up to now this yr and rental automobile fleet sales dipped barely after a miniscule gain in March.

Bobit, owner of Automotive Fleet, compiles fleet sales numbers that reflect aggregate sales from the three major Detroit-based auto manufacturers and the Asian Big 6 manufacturers. Numbers for April 2024 broken down by sector show:

- Business Fleets: 71,213 vehicles sold in April 2024, down 14.3% from 83,078 in April 2023. That percentage decrease was 0.1% ahead of a 14.2% monthly year-over-year (YOY) decline in January and the steepest monthly fall since a 22% YOY dip in November 2023.

- Rental Fleets: 105,261 vehicles sold in April 2024, down 2% from 107,421 in April 2023. Within the last two months, auto rental fleet sales have gone from a spike to flat, up 0.3% in March and up a powerful 46% in February.

- Government Fleets: 25,835 vehicles sold in April 2024, up 8.3% from 23,863 in April 2023. 4 automakers — Hyundai, Nissan, Subaru, and Toyota — haven’t reported government fleet sales for February through April, while Hyundai, Nissan, and Toyota didn’t report numbers for January.

April government fleet sales are at their highest monthly total up to now in 2024, rising from 19,821 in January.

In sum, total April 2024 fleet sales stood at 202,309, down 5.6% from 214,362 in April 2023.

To date in 2024, total monthly fleet sales have fallen year-over-year in March and April, while rising in January and February. Which means year-to-date (YTD) fleet sales are still holding on to a small increase, at 809,564, up 4.1% from 777,895 in Jan-April 2023.

“The vital number for me was 4.1% uptick YOY in fleet sales,” said Tom Kontos, chief economist for ADESA Auctions U.S. “That’s being driven by the rental fleet sales, that are up 16% YTD. As a share of recent vehicle sales, fleet sales were stable relative to latest vehicle sales. These are still respectable fleet sales numbers YTD.”

This Article First Appeared At www.automotive-fleet.com